🔮 The Future of AI in Financial Services: What’s Next for 2025 and Beyond

From robo-advisors to fraud detection systems, artificial intelligence has already reshaped the foundations of financial services. But we’re just scratching the surface. As we move deeper into 2025 and beyond, AI in finance is poised to become not just a support tool—but a strategic partner, innovation engine, and competitive differentiator.

This article explores the emerging trends, technologies, and disruptive shifts defining the future of AI in financial services.

🧠 From Automation to Intelligence

Financial institutions are moving past basic automation toward agentic AI—autonomous systems that:

- Set goals

- Take proactive action

- Adapt in real time

- Collaborate across platforms

We’re entering an era where AI doesn’t wait to be told what to do—it decides, acts, and learns continuously.

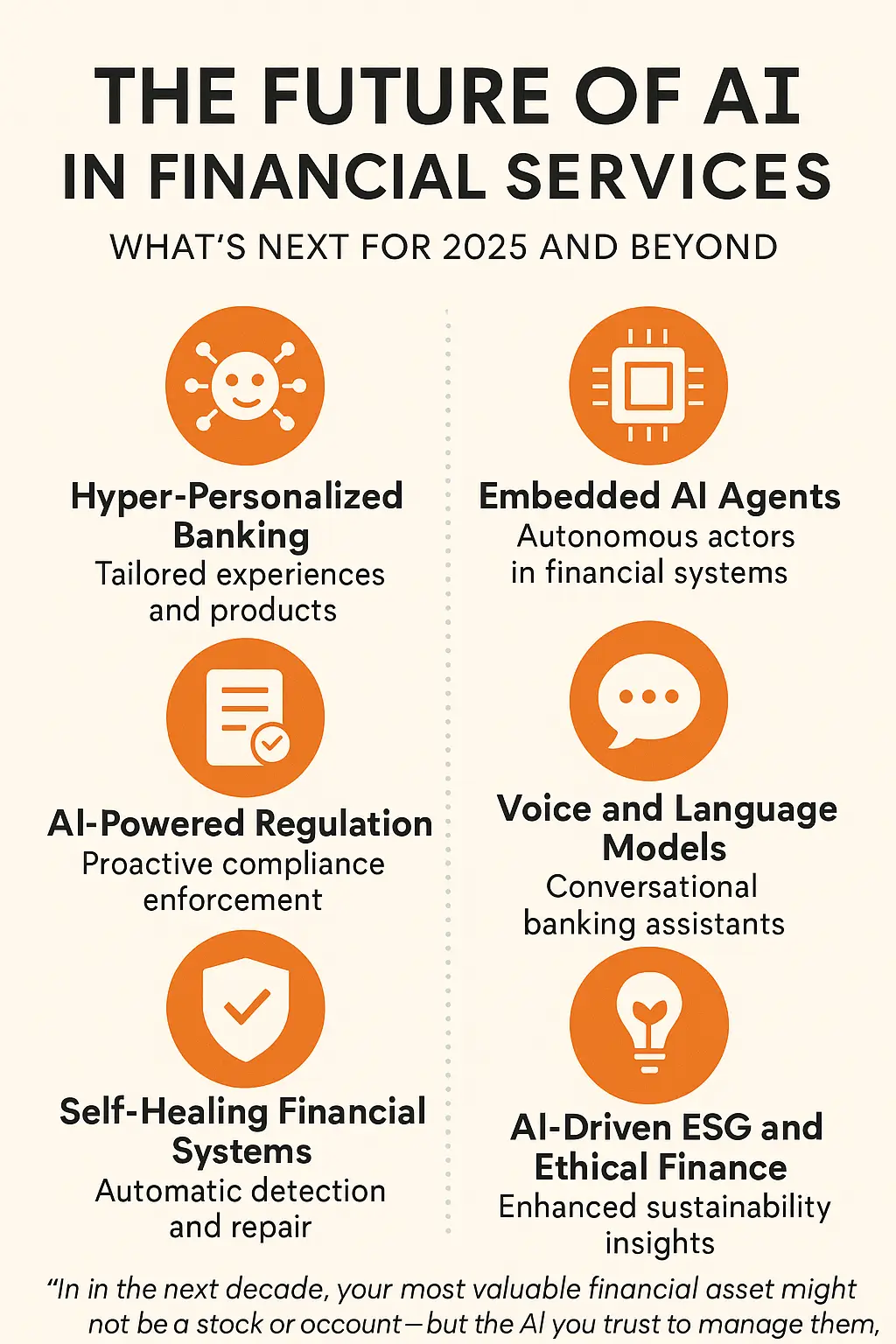

🚀 Key Trends Shaping the Future

1. Hyper-Personalized Banking

AI will power financial experiences tailored to each customer’s behavior, goals, and context in real time.

- Dynamic interest rates based on spending behavior

- Custom investment paths aligned to life milestones

- Voice-activated digital assistants for financial queries

💡 AI will make finance feel as personal as a private banker—with the speed of a machine.

2. Embedded AI Agents Across the Financial Stack

Financial products won’t just run on AI—they’ll be AI-driven.

- Autonomous agents optimizing portfolio allocation

- Smart lending systems negotiating loan terms

- Insurance bots evaluating risk in real time using IoT data

🏗️ AI will be the logic layer across retail banking, asset management, payments, and insurance.

3. AI-Powered Regulation (RegTech 2.0)

Instead of reacting to regulation, banks will use AI to:

- Interpret new policies as they emerge

- Adjust reporting in real time

- Proactively identify compliance risks

📄 Regulators themselves may use AI to monitor institutions—creating a two-way AI-powered compliance ecosystem.

4. Voice and Language Models in Wealth and Retail Banking

Large Language Models (LLMs) will be at the heart of financial interaction:

- Conversational financial planning

- AI-generated portfolio summaries

- Real-time language translation for global banking

🗣️ ChatGPT-like systems will evolve into your multilingual personal finance coach.

5. Self-Healing Financial Systems

With AI, infrastructure will detect and fix problems on its own:

- Preemptively rebalancing liquidity to avoid outages

- Switching between data pipelines automatically

- Healing cybersecurity vulnerabilities before they’re exploited

🛡️ The financial grid of the future will repair and defend itself.

6. AI-Driven ESG and Ethical Finance

AI will enable banks to:

- Measure environmental and social impact at the transaction level

- Automatically screen for ethical investment criteria

- Ensure supply chains meet sustainability targets

🌱 Finance will no longer just follow ESG standards—it will enforce and optimize them through AI.

📊 Industry Impact Forecast

| Sector | AI Transformation |

|---|---|

| Retail Banking | Virtual agents, instant underwriting, smart spending nudges |

| Wealth Management | AI-augmented advisors, continuous portfolio rebalancing |

| Lending | Dynamic credit scoring, AI-negotiated loans |

| Insurance | Behavior-based pricing, autonomous claim validation |

| Payments | Fraud prevention, frictionless identity verification |

⚠️ Challenges Ahead

Despite the momentum, there are serious hurdles:

- Bias & fairness: AI must be audited for discriminatory behavior

- Explainability: Black-box models need to justify decisions

- Data privacy: Regulators will crack down on overreach

- Human-AI balance: The industry must decide what stays in human hands

The institutions that get governance right will build lasting trust and regulatory alignment.

🌐 Final Thoughts: Finance, Reimagined

The future of AI in financial services is not about replacing humans—it’s about building a smarter, faster, more adaptive financial system that serves more people, more fairly, and more efficiently.

“In the next decade, your most valuable financial asset might not be a stock or account—but the AI you trust to manage them.”