🔐 AI-Powered Fraud Detection & Prevention: The New Defense in Digital Finance

In an increasingly digital and real-time financial world, fraud no longer moves in slow motion. It happens in milliseconds—across borders, platforms, and channels. In response, banks, fintechs, and payment processors are embracing a formidable new ally: AI-powered fraud detection and prevention.

AI is not only transforming how we detect fraud—it’s revolutionizing how we predict, prevent, and respond to it. This is more than an upgrade. It’s a necessary evolution for survival in the modern financial ecosystem.

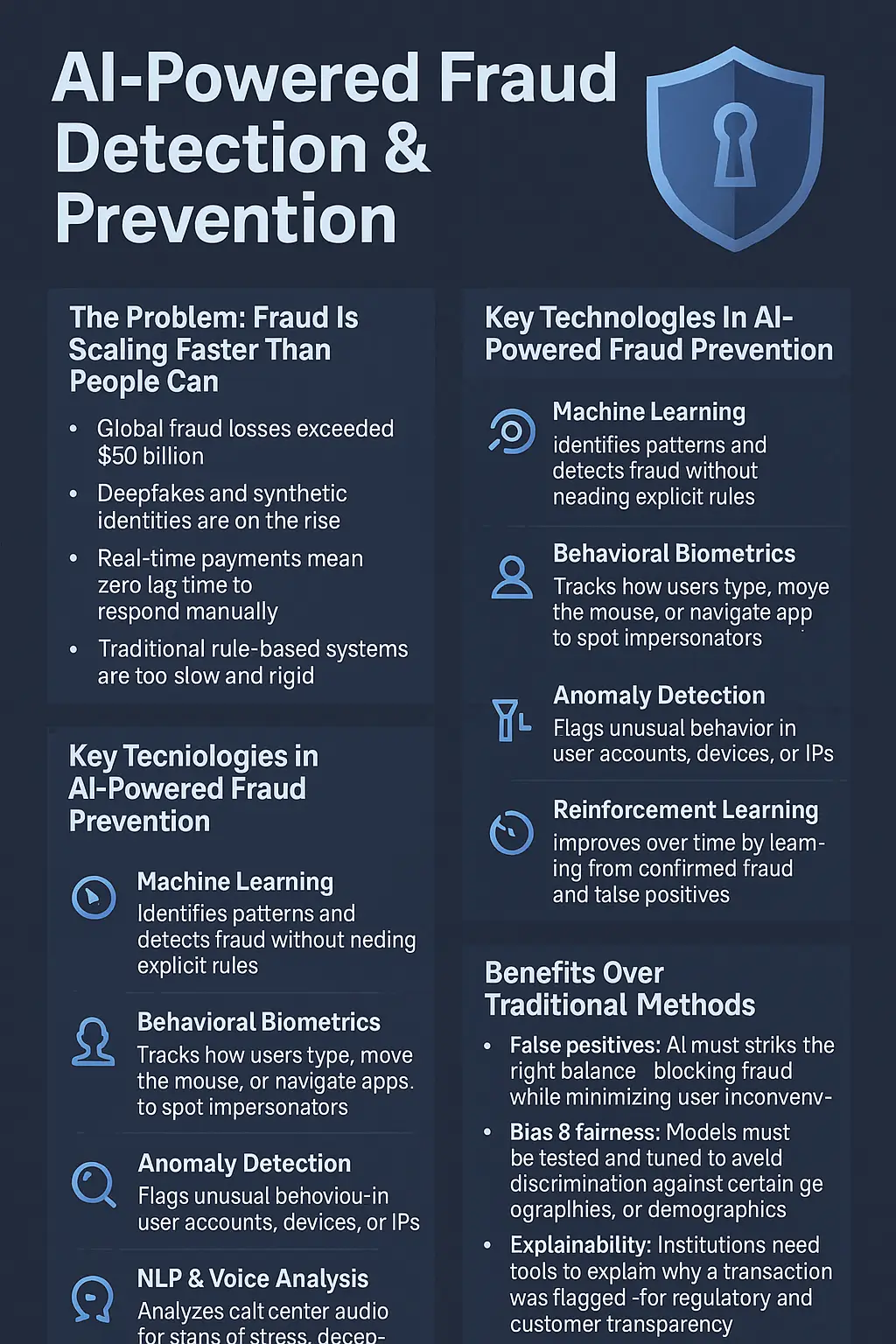

⚠️ The Problem: Fraud Is Scaling Faster Than People Can

- In 2024, global fraud losses exceeded $50 billion

- Deepfakes and synthetic identities are on the rise

- Real-time payments mean zero lag time to respond manually

- Traditional rule-based systems are too slow and rigid

The volume, complexity, and speed of financial crime has outpaced the capacity of human teams and static fraud filters.

🤖 The Solution: AI-Powered Defense Systems

AI-powered fraud systems go far beyond keyword triggers or transaction thresholds. They:

- Analyze behavior across accounts in real time

- Detect anomalies invisible to rule-based systems

- Predict fraudulent intent before a transaction completes

- Respond autonomously—flagging, blocking, or escalating instantly

Machine learning models are trained on millions of transactions, constantly evolving to detect patterns of fraud—even as criminals change tactics.

🔍 Key Technologies in AI-Powered Fraud Prevention

| Technology | Role |

|---|---|

| 🧠 Machine Learning | Identifies patterns and detects fraud without needing explicit rules |

| 📍 Behavioral Biometrics | Tracks how users type, move the mouse, or navigate apps to spot impersonators |

| 🧬 Anomaly Detection | Flags unusual behavior in user accounts, devices, or IPs |

| 🔄 Reinforcement Learning | Improves over time by learning from confirmed fraud and false positives |

| 🔊 NLP & Voice Analysis | Analyzes call center audio for signs of stress, deception, or social engineering |

🛠️ Real-World Examples

- Bank of America uses AI to detect account takeovers by monitoring login device behavior.

- Stripe Radar prevents fraud in e-commerce by analyzing billions of global transaction patterns.

- PayPal uses machine learning to intercept suspicious login attempts before funds are accessed.

✅ Benefits Over Traditional Methods

| Traditional Fraud Detection | AI-Powered Fraud Prevention |

|---|---|

| Static rules | Adaptive intelligence |

| Manual review | Automated response |

| Delayed alerts | Real-time intervention |

| High false positives | Smart precision |

AI doesn’t just reduce fraud—it reduces friction for good customers, who no longer face unnecessary blocks or identity checks.

⚖️ Ethical & Operational Considerations

- False positives: AI must strike the right balance—blocking fraud while minimizing user inconvenience.

- Bias & fairness: Models must be tested and tuned to avoid discrimination against certain geographies or demographics.

- Explainability: Institutions need tools to explain why a transaction was flagged—for regulatory and customer transparency.

- Privacy: Behavioral data must be used responsibly, in line with GDPR and other global standards.

🚀 The Future: Autonomous Fraud Response Agents

Looking ahead, AI will not just detect fraud—it will:

- Negotiate with other agents in financial networks

- Adapt in real time to new types of attacks (e.g., AI-generated scams)

- Collaborate across institutions to create shared fraud intelligence ecosystems

“The next great financial security system won’t sit in a control room—it will be embedded in every transaction, powered by AI.”