The Solow Growth Model, named after economist Robert Solow, is a classic economic model used to explain long-term economic growth within the context of capital accumulation, labor or population growth, and increases in productivity. It’s a cornerstone in the field of macroeconomics, particularly in the study of economic development. Here’s a brief overview of its main components:

- Capital Accumulation: This is a key feature of the Solow Model. It posits that as a country invests more in capital (like machinery, infrastructure, etc.), its output increases, leading to economic growth.

- Labor Growth: The model takes into account the growth of the labor force. As the population increases, the workforce grows, potentially increasing output.

- Productivity (Technological Progress): Increases in productivity, often driven by technological innovation, are a crucial driver of economic growth in the Solow Model. It assumes that over time, with advancements in technology, each worker becomes more productive.

- Depreciation: The model also considers the depreciation or wearing out of capital over time. Constant investment is needed to replace depreciated capital to maintain the production capacity.

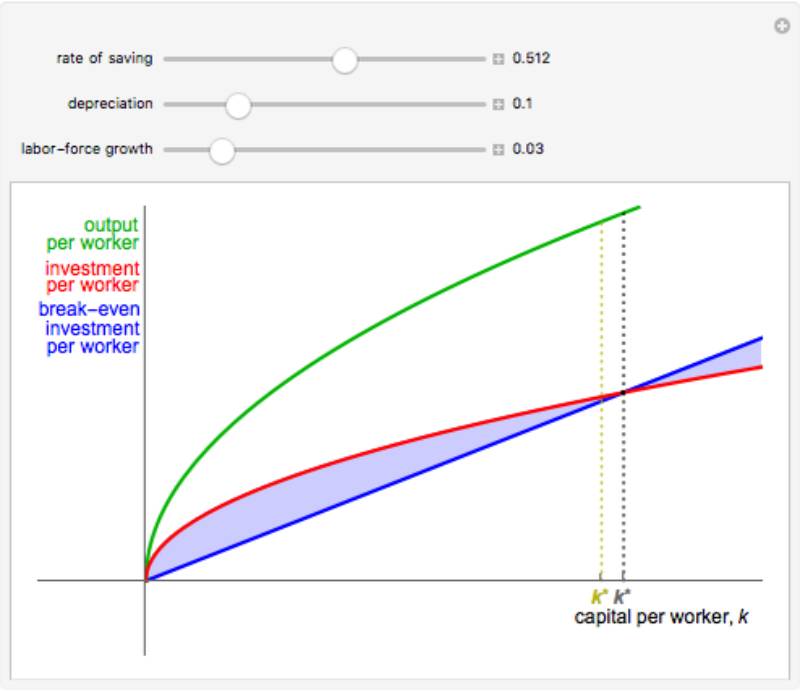

- Steady State: A key concept in the Solow Model is the ‘steady state’, where the economy eventually reaches a point where continued capital accumulation no longer leads to economic growth, as increases in capital are offset by depreciation and a rising population.

- Savings and Investment: The model emphasizes the role of savings and investment in capital accumulation. A higher savings rate can lead to a higher steady state of capital and output but doesn’t affect the long-term growth rate.

- Convergence Hypothesis: According to the Solow Model, poorer countries should grow faster than richer ones, allowing them to ‘catch up’ in terms of economic development. This is due to diminishing returns to capital; it’s more productive to invest in a country with less capital.

In summary, the Solow Growth Model provides a framework for understanding the dynamics of economic growth, emphasizing the role of capital accumulation, labor growth, and technological progress. While it has been influential, it’s also been subject to criticism and modifications over the years, particularly regarding its assumptions about technology and market functions.

See the live demonstration here: https://demonstrations.wolfram.com/SolowGrowthModel/

Let’s consider a practical example involving the application of the Solow Growth Model in analyzing the economic development of a hypothetical country:

### Country Profile:

– Name: Econoland

– Current Status: Developing country with a focus on agriculture and light industry.

– Key Issues: Low levels of capital investment, high population growth, and limited access to advanced technology.

### Application of the Solow Growth Model:

1. **Capital Accumulation**:

– Econoland has low levels of capital investment. The Solow Model suggests that increasing investment in capital goods (like machinery and infrastructure) would significantly boost its economic output.

– Example: The government could encourage foreign investment or allocate more budget to infrastructure projects.

2. **Labor Growth**:

– The country experiences high population growth. While this increases the labor force, the Solow Model indicates that without corresponding growth in capital and technology, this can lead to diminishing per capita returns.

– Example: Implementing policies to improve education and vocational training can increase the productivity of this growing workforce.

3. **Technological Progress**:

– Econoland lags in technological advancement. According to the Solow Model, technological progress is key to sustainable long-term growth.

– Example: Investing in research and development, and adopting technologies from more advanced countries, can enhance productivity.

4. **Moving Towards Steady State**:

– Using the Solow Model, economists can predict the steady-state level of capital for Econoland, where the economy would stabilize if it continues on its current path.

– Example: Analyzing current investment rates and depreciation, the government can set targets for investment to reach an optimal steady state.

5. **Policy Recommendations**:

– The model suggests that increasing the savings rate, improving capital efficiency, and investing in human capital and technology are crucial.

– Example: Econoland could introduce tax incentives for savings and investment, establish technology parks, and reform its education system.

6. **Convergence Hypothesis**:

– Econoland, being a poorer country, should theoretically grow faster than richer countries, according to the convergence hypothesis of the Solow Model.

– Example: By benchmarking against more developed economies and understanding their growth trajectories, Econoland can set realistic growth targets.

### Conclusion:

In this example, the Solow Growth Model helps Econoland’s policymakers understand the key drivers of economic growth and the importance of balanced development in capital, labor, and technology. It guides them in formulating policies that foster sustainable long-term growth, ultimately helping the country develop economically.