Economic models are simplified, abstract representations of complex economic processes and systems. They are used by economists to analyze, interpret, and make predictions about economic behavior and interactions. Here are some key aspects and types of economic models:

- Purpose of Economic Models:

- Simplification: Economic models simplify the complexities of real-world economies to focus on essential aspects.

- Analysis and Prediction: They help in analyzing how economies function and in predicting the effects of economic policies and events.

- Decision-Making: Models provide a framework for policymakers and businesses to make informed decisions.

- Types of Economic Models:

- Microeconomic Models: Focus on individual agents, like households and firms, and their interactions. Examples include supply and demand models, game theory models, and models of consumer choice.

- Macroeconomic Models: Examine the economy as a whole, including total output, employment, inflation, and economic growth. Key examples are the IS-LM model (Investment Saving-Liquidity preference Money supply) and the Solow Growth Model.

- Econometric Models: Use statistical methods to test hypotheses and forecast future trends based on historical data.

- Computational Models: Utilize complex algorithms to simulate the behavior of economic systems under various scenarios.

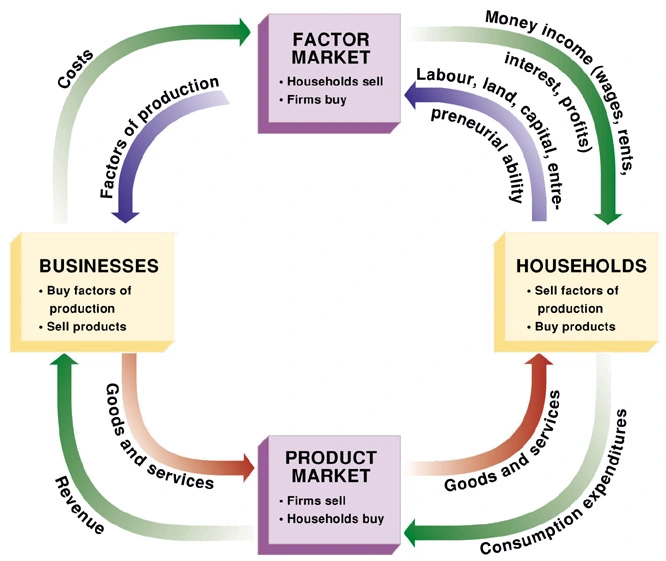

The Circular Flow Economic Model is a fundamental concept in economics that illustrates the continuous flow of money, goods, services, and factors of production in an economy. This model simplifies the workings of an economy by focusing on interactions between different sectors. Here are the key elements of this model:

- Basic Structure:

- The model typically involves two main sectors: households and businesses.

- Households provide factors of production (like labor, land, and capital) to businesses, and in return, they receive wages, rent, dividends, and interest.

- Businesses use these factors of production to produce goods and services, which they sell to households.

- The money and resources flow continuously between these two sectors, creating a circular flow.

- Two Types of Flows:

- Real Flow: The flow of factors of production from households to businesses and the flow of goods and services from businesses to households.

- Monetary Flow: The flow of money, including wages, rent, interest, and profits, from businesses to households, and the flow of consumer spending from households to businesses.

- Extended Versions of the Model:

- The basic model can be extended to include the government, financial sector, and foreign trade.

- Government: Taxes flow from households and businesses to the government, and government spending flows back to these sectors.

- Financial Sector: Households save money in financial institutions and receive interest; businesses borrow money for investment.

- Foreign Trade: Includes exports (goods and services sold overseas) and imports (goods and services purchased from abroad).

- Significance:

- This model helps in understanding how different sectors of the economy are interconnected.

- It demonstrates the interdependence between producers (businesses) and consumers (households).

- It provides a basic framework for understanding how money and resources circulate in the economy.

- Assumptions:

- The circular flow model makes several simplifying assumptions, such as ignoring the roles of government intervention and international trade in the basic version.

- Educational Tool:

- It’s often used as an introductory tool in economics to help students grasp the basic functioning of an economy.

The circular flow model is an idealized representation and doesn’t capture every aspect of real-world economies, such as the impact of technological change or the role of uncertainty. However, it serves as a foundational concept for understanding economic activity and the interrelationships within an economy.