⚠️ Will AI Replace Financial Advisors? What the Data Says in 2025

The rise of artificial intelligence has ignited a burning question across the financial industry:

Will AI replace human financial advisors?

With robo-advisors managing billions, and AI-driven platforms offering personalized planning at scale, many clients—and professionals—are wondering what the future holds. The answer isn’t simple. But in 2025, we have enough data, adoption, and behavioral trends to offer real insight.

Let’s break down what’s really happening—and what it means for the future of financial advice.

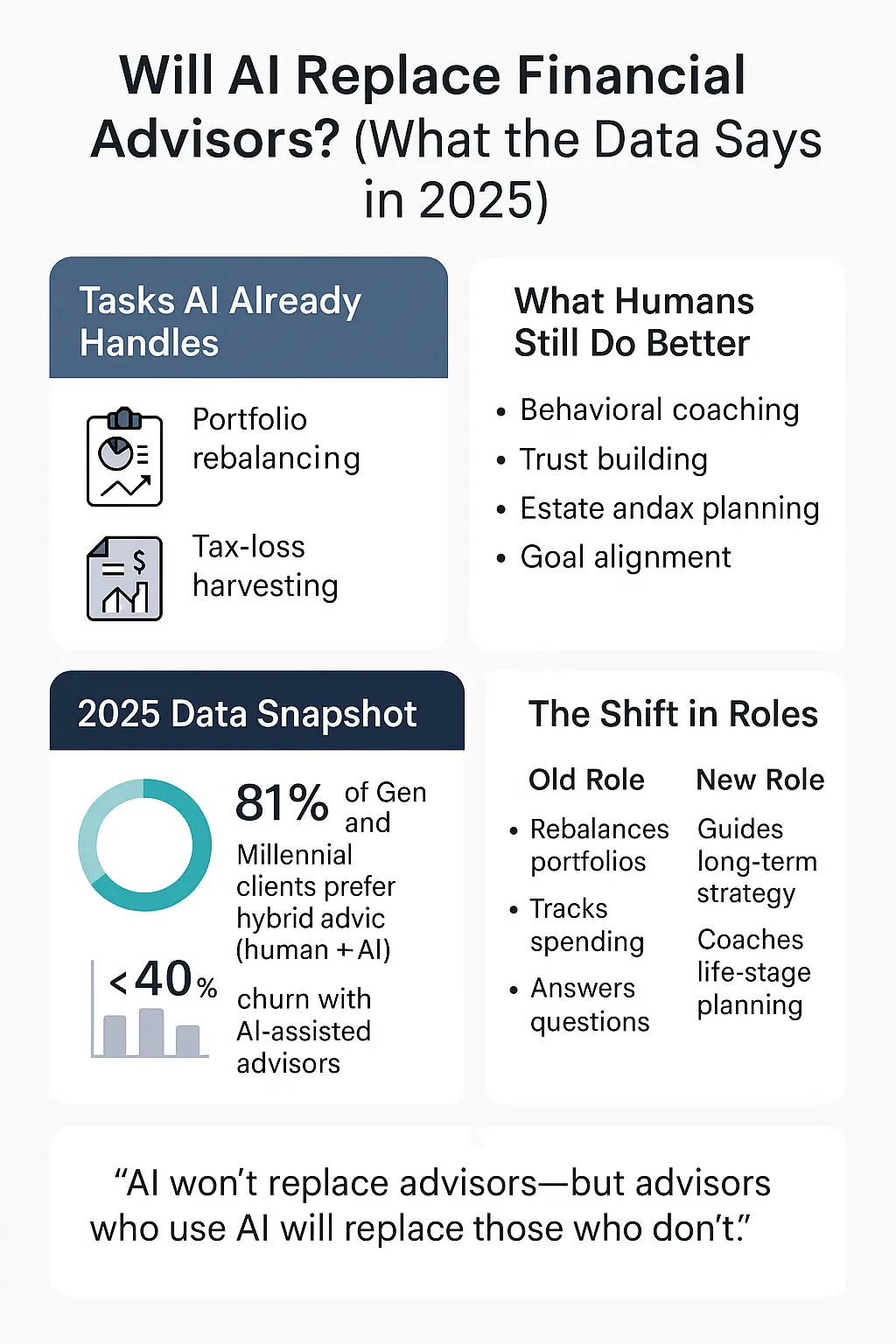

🤖 Where AI Is Already Replacing Traditional Roles

AI is not a future trend—it’s already reshaping how clients interact with financial services:

| AI Capability | Replacing… |

|---|---|

| ✅ Portfolio rebalancing | Manual model updates |

| 📊 Tax-loss harvesting | Year-end accountant reviews |

| 💬 Budget coaching | Entry-level advisory support |

| 🔄 Risk profiling | Static questionnaires |

| 📈 Investment recommendations | Basic model portfolios |

In short, AI is eating the “80%” of tasks that are repeatable, reactive, and rules-based.

🧠 What Humans Still Do Better

Despite AI’s strengths, humans remain essential in areas where empathy, intuition, and experience are irreplaceable:

- 🧭 Behavioral coaching during market crashes

- 🤝 Trust building in high-net-worth or multi-generational wealth

- 🧾 Estate and tax planning for complex family structures

- 🧍 Goal alignment for evolving life stages

- 💬 Conflict resolution in joint accounts or business partnerships

Even the best AI can’t read the room, pick up emotional subtext, or walk a client through grief-driven decisions. Money is emotional—and that’s still a human edge.

🧮 What the Data Shows in 2025

- 💼 81% of Gen Z and Millennials prefer hybrid models that combine AI tools with human advisors (Source: Deloitte)

- 📉 Firms using AI-enhanced advice report 40% lower churn and higher client satisfaction (Source: McKinsey)

- 🧠 AI-assisted advisors handle 2–3x more clients, improving access and profitability

The clear winner isn’t AI vs. human—it’s AI + human.

🔄 The Shift: From Advisor to Financial Strategist

As AI takes over operational work, the advisor’s role evolves from manual manager to trusted strategist:

| Old Role | New Role |

|---|---|

| Rebalances portfolios | Guides long-term strategy |

| Tracks spending | Coaches life-stage planning |

| Answers questions | Asks the right ones |

| Manages risk | Manages relationships |

Future advisors will work alongside AI, interpreting its output, providing context, and managing complexity—not competing with it.

🛡️ Why Some Advisors Will Thrive—and Others Won’t

Success depends on embracing the tools, not resisting them. Advisors who thrive in this new landscape will:

- Use AI to scale and personalize advice

- Focus on coaching and complex planning

- Offer proactive insights based on client data

- Evolve from asset manager to life planner

Advisors who refuse to adapt risk becoming irrelevant as clients demand more efficiency, transparency, and personalization.

🔮 Final Thoughts: A Human Future with AI at Your Side

“AI won’t replace financial advisors. But financial advisors who use AI will replace those who don’t.”

The future of finance isn’t binary. It’s blended. AI is already transforming the industry, but it’s not here to replace empathy, judgment, or trust. It’s here to amplify them.

For clients, the question isn’t should I trust AI or a human?

It’s: Who’s using both to serve me best?