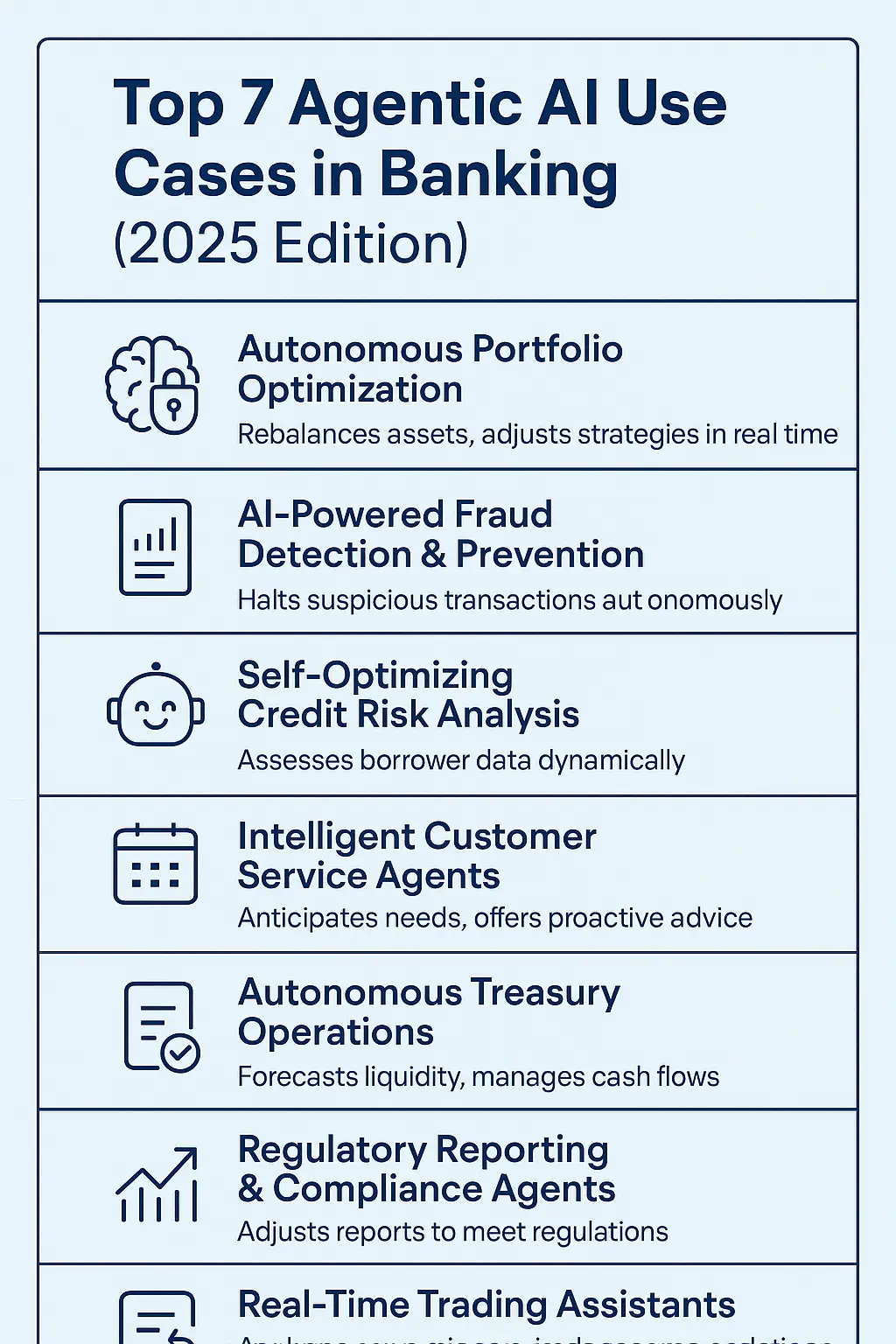

🔍 Top 7 Agentic AI Use Cases in Banking (2025 Edition)

As artificial intelligence continues to revolutionize industries, nowhere is the impact more profound than in banking. In 2025, the frontier of innovation is being pushed by agentic AI—autonomous systems that don’t just analyze data but set goals, take initiative, and make decisions in real time.

These aren’t your typical chatbots or analytics tools. Agentic AI brings a new level of intelligence, adapting on the fly to economic volatility, customer behavior, and internal financial systems. In this article, we explore the top 7 real-world use cases of agentic AI in banking—and why they matter now more than ever.

1. 🧠 Autonomous Portfolio Optimization

Gone are the days of static robo-advisors. Agentic AI can now dynamically adjust investment portfolios based on real-time market data, news sentiment, and geopolitical signals. These systems:

- Rebalance assets instantly

- Harvest tax losses proactively

- Adjust strategies for inflation or interest rate hikes

🔁 Why it matters: Investors no longer need to react to volatility—agentic systems do it for them, 24/7.

2. 🔐 AI-Powered Fraud Detection & Prevention

Traditional fraud detection systems flag suspicious transactions. Agentic AI goes further: it halts them autonomously, communicates with internal teams, and even re-routes payment flows when needed. These agents continuously learn from fraud patterns, evolving beyond pre-defined rules.

🛡️ Why it matters: In 2025’s world of instant payments and global transactions, real-time response is essential.

3. 📊 Self-Optimizing Credit Risk Analysis

Loan approval is no longer a fixed decision-tree process. Agentic AI can:

- Collect dynamic borrower data

- Assess risk across multiple institutions

- Continuously update risk scores post-loan issuance

🏦 Why it matters: It enables more inclusive, faster lending decisions without increasing default rates.

4. 🤖 Intelligent Customer Service Agents

These agents don’t just answer FAQs—they:

- Anticipate customer needs

- Trigger alerts for payment deadlines

- Propose personalized financial advice

- Schedule appointments with human advisors

💬 Why it matters: Customer support becomes proactive, contextual, and hyper-personalized.

5. 📅 Autonomous Treasury Operations

In corporate and investment banking, agentic AI is transforming back-office operations:

- Forecasting liquidity

- Scheduling debt repayments

- Balancing international cash flows

- Making intra-day funding decisions

🔄 Why it matters: It reduces operational risk and saves hundreds of hours per month in treasury teams.

6. 💡 Regulatory Reporting & Compliance Agents

Agentic systems can interpret new regulations, adjust internal reporting frameworks, and submit compliance reports automatically. They cross-reference data across systems to flag potential non-compliance before an audit ever happens.

📄 Why it matters: Regulatory requirements are only getting more complex. Autonomy makes them manageable.

7. 📈 Real-Time Trading Assistants

Traders are increasingly co-piloting with agentic systems that:

- Analyze newsfeeds and earnings in real time

- Trigger buy/sell recommendations based on strategic objectives

- Simulate outcomes of trades before execution

📉 Why it matters: Human traders get speed, precision, and insight—without handing over complete control.

🚀 The Bottom Line: From Automation to Intelligence

Agentic AI in banking goes beyond rule-based automation. It’s adaptive, proactive, and often invisible, working behind the scenes to enhance profitability, customer experience, and operational resilience.

As financial institutions race to stay competitive in 2025, those that invest in agentic systems will be positioned not just as banks—but as intelligent, responsive ecosystems built for the future.

“The smartest financial decisions in 2025 might not be made by humans—but by the agents we’ve trained to act on our behalf.”