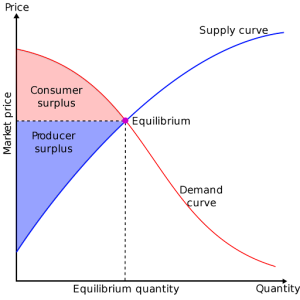

Consumer surplus and producer surplus are fundamental concepts within microeconomic theory, closely related to the well-being of consumers and producers in the market. These concepts serve as invaluable tools for policymakers in assessing the impacts of various economic policies on societal welfare.

Consumer surplus represents the difference between the total amount consumers are willing and able to pay for a good or service—indicated by the demand curve—and the actual amount they pay—the market price. It signifies the additional utility consumers receive compared to what they expend (Mankiw & Taylor, 2010). Producer surplus, on the other hand, is the difference between the amount a producer is paid for a good or service—the market price—and the minimum amount the producer would have been willing to accept to produce it—the production cost. This surplus represents the extra benefit producers gain from selling their goods or services at market prices (Mankiw & Taylor, 2010).

When combined, consumer surplus and producer surplus offer a comprehensive view of economic welfare known as “total surplus” or “economic surplus.” This total surplus is maximized in a perfectly competitive market, where supply meets demand at the equilibrium price and quantity. Under this condition, resources are said to be allocated efficiently, leading to the greatest social welfare (Pseiridou & Lianos, 2015).

Source: Economic surplus. (2022, August 17). Wikipedia. Retrieved October 22, 2023 from https://en.wikipedia.org/wiki/Economic_surplus#/media/File:Economic-surpluses.svg

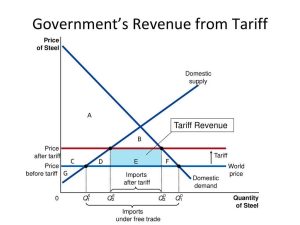

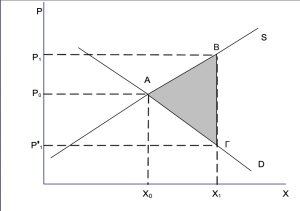

However, in real markets, various government interventions in market prices, such as tariffs, price controls, taxes, subsidies, and guaranteed prices, can significantly impact consumer surplus, producer surplus, and, consequently, overall social welfare. For instance, taxes on imported goods are sometimes increased to protect local industries from foreign competition. By imposing tariffs, governments make these products more expensive, encouraging consumers to purchase domestic products. Initially, this approach may increase the surplus of domestic producers, allowing them to raise their prices above the international price, thereby encouraging production. However, it simultaneously reduces consumer surplus, as consumers, faced with higher prices for domestic products, reduce their consumption, creating a deadweight loss from the imposition of the tariff.

The combined regions D and F illustrate the reduction in overall surplus attributable to the tariff, representing a deadweight loss.

| Before the tariff | After the tariff | Change due to the tariff | |

|---|---|---|---|

| Consumer surplus | A + B + C + D + E + F | A + B | -(C + D + E + F) |

| Producer surplus | G | C + G | + C |

| Government’s tariff revenue | – | E | + E |

| Total surplus | A + B + C + D + E + F + G | A + B + C + E + G | -(D + F) |

Source: ΕΛΛΗΝΙΚΗ ΔΗΜΟΚΡΑΤΙΑ ΠΑΝΕΠΙΣΤΗΜΙΟ ΚΡΗΤΗΣ ΟΙΚΟΝΟΜΙΚΗ ΑΝΑΛΥΣΗ. (n.d.). Retrieved October 22, 2023, from https://opencourses.uoc.gr/courses/pluginfile.php/11220/mod_resource/content/0/10.%CE%A4%CE%9F%20%CE%94%CE%99%CE%95%CE%98%CE%9D%CE%95%CE%A3%20%CE%95%CE%9C%CE%A0%CE%9F%CE%A1%CE%99%CE%9F.pdf

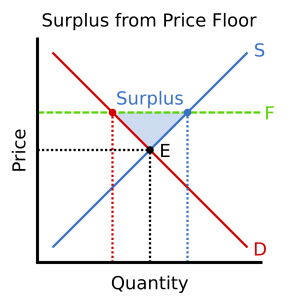

Accordingly, price controls in the form of price floors and price ceilings are tools used by governments. A price floor is a mandatory minimum price for a good or service and is generally set above the equilibrium price (otherwise, it is ineffective) to ensure a minimum income for the producers of these goods or services. A price floor usually reduces consumer surplus because consumers have to pay higher prices, resulting in a decreased quantity demanded. Some consumers are completely displaced from the market, losing the consumer surplus they would have enjoyed without the price floor. The producer surplus may initially increase due to the higher price, leading to greater profits from each unit sold. However, because the higher price reduces the quantity demanded, producers may end up with surplus inventory, especially if they increased production in anticipation of higher profits. This unsold surplus effectively reduces the total surplus of the producer. In this situation, neither consumers nor producers fully benefit (OpenStaxCollege, n.d.).

Source: Συνεισφέροντες στα εγχειρήματα Wikimedia. (2022, March 13). Κατώτατο όριο τιμής. Wikipedia.org; Wikimedia Foundation, Inc. Wikipedia.org; Wikimedia Foundation, Inc. Retrieved October 22, 2023 from https://el.wikipedia.org/wiki/%CE%9A%CE%B1%CF%84%CF%8E%CF%84%CE%B1%CF%84%CE%BF_%CF%8C%CF%81%CE%B9%CE%BF_%CF%84%CE%B9%CE%BC%CE%AE%CF%82#/media/%CE%91%CF%81%CF%87%CE%B5%CE%AF%CE%BF:Surplus_from_Price_Floor.svg

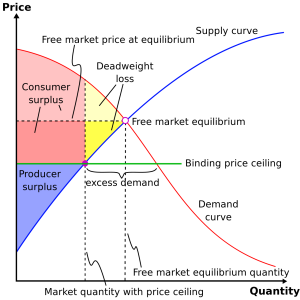

A price ceiling is a mandatory maximum price set for a good or service, typically established below the equilibrium price (otherwise, it would be ineffective) to make these goods and services more affordable. Initially, a price ceiling may increase consumer surplus for a product, as consumers can purchase the same quantity at a lower price. However, because the lower price increases the quantity demanded while usually reducing the quantity supplied, it often leads to a shortage. This shortage can impact consumer surplus, as consumers spend time and resources searching for the hard-to-find product, or in some cases, are unable to purchase it at all. On the other hand, producer surplus decreases because the lower price reduces the margin between production costs and selling price. Furthermore, producers may reduce the quantity supplied due to the lower price, further diminishing producer surplus (OpenStaxCollege, n.d.).

Source: Συνεισφέροντες στα εγχειρήματα Wikimedia. (2022, March 10). Ανώτατο όριο τιμής. Wikipedia.org; Wikimedia Foundation, Inc. Retrieved October 22, 2023 from https://el.wikipedia.org/wiki/%CE%91%CE%BD%CF%8E%CF%84%CE%B1%CF%84%CE%BF_%CF%8C%CF%81%CE%B9%CE%BF_%CF%84%CE%B9%CE%BC%CE%AE%CF%82#/media/%CE%91%CF%81%CF%87%CE%B5%CE%AF%CE%BF:Binding-price-ceiling.svg

In both scenarios, price controls, by imposing minimum or maximum price limits, create market inefficiencies that lead to a reduction in overall economic welfare (OpenStaxCollege, n.d.). While these tools can be used for social policy reasons (such as affordable housing or ensuring stable income), they may lead to unintended consequences like shortages, surpluses, and black markets. The overall effect is typically a loss in social welfare, known as a deadweight loss.

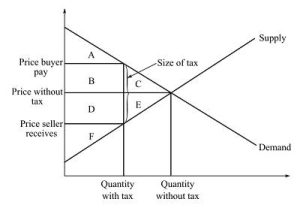

In certain cases, taxes are utilized as tools of fiscal policy to assist in stabilizing the economy. For instance, a government may reduce taxes on specific goods and services with the aim of boosting demand. Conversely, it might increase taxes to discourage the consumption of goods and services it deems harmful or potentially dangerous, such as tobacco products and alcoholic beverages. Similar to tariffs, which are a type of tax, taxes by reducing the surplus of consumers and producers, ultimately lead to a decrease in overall social welfare, causing a deadweight loss.

Source: ΕΛΛΗΝΙΚΗ ΔΗΜΟΚΡΑΤΙΑ ΠΑΝΕΠΙΣΤΗΜΙΟ ΚΡΗΤΗΣ ΟΙΚΟΝΟΜΙΚΗ ΑΝΑΛΥΣΗ. (n.d.). Retrieved October 22, 2023, from https://opencourses.uoc.gr/courses/pluginfile.php/11220/mod_resource/content/0/10.%CE%A4%CE%9F%20%CE%94%CE%99%CE%95%CE%98%CE%9D%CE%95%CE%A3%20%CE%95%CE%9C%CE%A0%CE%9F%CE%A1%CE%99%CE%9F.pdf

The combined regions C and E illustrate the reduction in overall surplus attributable to the tax, representing a deadweight loss.

| Before the tax | After the tax | Change due to the tax | |

|---|---|---|---|

| Consumer surplus | A + B + C | A | -(B + C) |

| Producer surplus | D + E + F | F | -(D + E) |

| Government’s tax revenue | – | B + D | +(B + D) |

| Total surplus | A + B + C + D + E + F | A + B + D + F | -(C + E) |

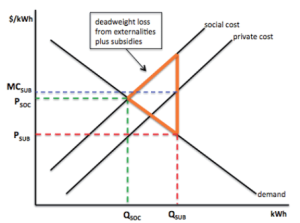

Subsidies involve providing financial assistance to producers or consumers. They can increase producer surplus, making it more economically viable for them to produce, while consumers can benefit from lower prices due to the subsidy, as the supply curve shifts to the right. However, subsidies often cause overproduction and consumption, creating social costs not reflected in market prices. This leads to a deadweight loss from externalities. The production and consumption occurring due to the subsidy do not add de facto real value to the economy as a whole, while it may divert resources from more efficient uses, reducing overall economic welfare (Gopal et al., 2013).

Source: Gopal, Anand & Leventis, Greg & de la Rue du Can, Stephane & Shah, Nihar & Phadke, Amol. (2013). Trading appliance efficiency for electricity subsidies: the potential in emerging economies. Retrieved October 22, 2023 from https://www.researchgate.net/publication/265088004_Trading_appliance_efficiency_for_electricity_subsidies_the_potential_in_emerging_economies

Guaranteed prices refer to an economic policy intervention, typically by the government, where producers are assured a specific price for their products or services, regardless of market conditions. If market prices fall below the guaranteed level, the government or a designated agency purchases the surplus production or covers the price difference, ensuring producers receive a minimum guaranteed income. This can help protect producers from price volatility and unpredictable market fluctuations. The case of guaranteed prices has similar outcomes to subsidy provision, as it may lead to deadweight losses, risking overproduction.

Source: Τσεκούρας, Κ. (2014, May 11). Κοινωνικοοικονομική Αξιολόγηση Επενδύσεων – Επιπτώσεις Επενδυτικών Έργων και Μέτρων Πολιτικής. Https://Eclass.upatras.gr/. Retrieved October 22, 2023 from https://eclass.upatras.gr/modules/document/file.php/ECON1303/%CE%A0%CE%B1%CF%81%CE%BF%CF%85%CF%83%CE%B9%CE%AC%CF%83%CE%B5%CE%B9%CF%82%20%CE%94%CE%B9%CE%B1%CE%BB%CE%AD%CE%BE%CE%B5%CF%89%CE%BD/Lect4_%CE%95%CF%80%CE%B9%CF%80%CF%84%CF%8E%CF%83%CE%B5%CE%B9%CF%82%20%CE%95%CF%80%CE%B5%CE%BD%CE%B4%CF%85%CF%84%CE%B9%CE%BA%CF%8E%CE%BD%20%CE%88%CF%81%CE%B3%CF%89%CE%BD.pdf

In summary, analyzing consumer and producer surplus allows policymakers to understand the distribution of costs and benefits and to make decisions regarding the maintenance, adjustment, or abolition of regulations that impose them. If the increase in total surplus (social welfare) is positive, the policy can be considered beneficial for society. Often, however, government interventions cause market imbalances, disrupting the free market’s self-regulating ability created by supply and demand forces. Artificially altering the price and quantity of goods and services leads to potential shortages, surpluses, and inefficiencies, while prices do not naturally adjust to reflect scarcity, abundance, and consumer preferences. Consequently, this can lead to misallocation of resources, uncompensated losses, and reduced overall economic welfare.

Bibliographical References

Economic surplus. (2022, August 17). Wikipedia. Retrieved October 22, 2023, from https://en.wikipedia.org/wiki/Economic_surplus#/media/File:Economic-surpluses.svg

Gopal, Anand & Leventis, Greg & de la Rue du Can, Stephane & Shah, Nihar & Phadke, Amol. (2013). Trading appliance efficiency for electricity subsidies: the potential in emerging economies. Retrieved October 22, 2023, from https://www.researchgate.net/publication/265088004_Trading_appliance_efficiency_for_electricity_subsidies_the_potential_in_emerging_economies

Mankiw G. N. & Taylor M.P. (2010, μετάφραση), «Αρχές Οικονομικής Θεωρίας», Τόμος Α’ – Μικροοικονομική, εκδόσεις Gutenberg

OpenStaxCollege. (n.d.). Demand, Supply, and Efficiency – Principles of Economics 3e | OpenStax. Openstax.org. Retrieved October 22, 2023, from https://openstax.org/books/principles-economics-3e/pages/3-5-demand-supply-and-efficiency

ΕΛΛΗΝΙΚΗ ΔΗΜΟΚΡΑΤΙΑ ΠΑΝΕΠΙΣΤΗΜΙΟ ΚΡΗΤΗΣ ΟΙΚΟΝΟΜΙΚΗ ΑΝΑΛΥΣΗ. (n.d.). Retrieved October 22, 2023, from https://opencourses.uoc.gr/courses/pluginfile.php/11220/mod_resource/content/0/10.%CE%A4%CE%9F%20%CE%94%CE%99%CE%95%CE%98%CE%9D%CE%95%CE%A3%20%CE%95%CE%9C%CE%A0%CE%9F%CE%A1%CE%99%CE%9F.pdf

Συνεισφέροντες στα εγχειρήματα Wikimedia. (2022, March 10). Ανώτατο όριο τιμής. Wikipedia.org; Wikimedia Foundation, Inc. Retrieved October 22, 2023 from https://el.wikipedia.org/wiki/%CE%91%CE%BD%CF%8E%CF%84%CE%B1%CF%84%CE%BF_%CF%8C%CF%81%CE%B9%CE%BF_%CF%84%CE%B9%CE%BC%CE%AE%CF%82#/media/%CE%91%CF%81%CF%87%CE%B5%CE%AF%CE%BF:Binding-price-ceiling.svg

Συνεισφέροντες στα εγχειρήματα Wikimedia. (2022, March 13). Κατώτατο όριο τιμής. Wikipedia.org; Wikimedia Foundation, Inc. Retrieved October 22, 2023 from https://el.wikipedia.org/wiki/%CE%9A%CE%B1%CF%84%CF%8E%CF%84%CE%B1%CF%84%CE%BF_%CF%8C%CF%81%CE%B9%CE%BF_%CF%84%CE%B9%CE%BC%CE%AE%CF%82#/media/%CE%91%CF%81%CF%87%CE%B5%CE%AF%CE%BF:Surplus_from_Price_Floor.svg

Τσεκούρας, Κ. (2014, May 11). Κοινωνικοοικονομική Αξιολόγηση Επενδύσεων – Επιπτώσεις Επενδυτικών Έργων και Μέτρων Πολιτικής. Https://Eclass.upatras.gr/. Retrieved October 27, 2023, https://eclass.upatras.gr/modules/document/file.php/ECON1303/%CE%A0%CE%B1%CF%81%CE%BF%CF%85%CF%83%CE%B9%CE%AC%CF%83%CE%B5%CE%B9%CF%82%20%CE%94%CE%B9%CE%B1%CE%BB%CE%AD%CE%BE%CE%B5%CF%89%CE%BD/Lect4_%CE%95%CF%80%CE%B9%CF%80%CF%84%CF%8E%CF%83%CE%B5%CE%B9%CF%82%20%CE%95%CF%80%CE%B5%CE%BD%CE%B4%CF%85%CF%84%CE%B9%CE%BA%CF%8E%CE%BD%20%CE%88%CF%81%CE%B3%CF%89%CE%BD.pdf

Ψειρίδου, Α., & Λιανός, Θ. (2015). Οικονομική ανάλυση & πολιτική – Μικροοικονομική. Kallipos, Open Academic Editions. http://hdl.handle.net/11419/2360