Introduction

Monte Carlo Simulation is a powerful computational technique used to model and analyze systems that involve uncertainty or randomness. By relying on repeated random sampling, it estimates complex mathematical or physical phenomena that might be analytically intractable. The method, named after the famous Monte Carlo Casino in Monaco, plays a crucial role in various fields, including finance, engineering, physics, and risk analysis. This article explores the fundamental principles, applications, and steps involved in Monte Carlo Simulation.

What is Monte Carlo Simulation?

Monte Carlo Simulation refers to a method for approximating solutions to quantitative problems by simulating random variables and using statistical sampling. The idea is to model the probability of different outcomes by running simulations many times and analyzing the results.

The core concept involves:

- Random Sampling: The system or process is represented using random variables, which are sampled repeatedly.

- Probability Distribution: Each random variable follows a specific probability distribution that represents the uncertainty in the system.

- Aggregation of Results: The results of individual simulations are aggregated to provide insights into the range and likelihood of potential outcomes.

Monte Carlo Simulation is particularly useful when dealing with problems that are analytically difficult to solve or when uncertainty plays a significant role.

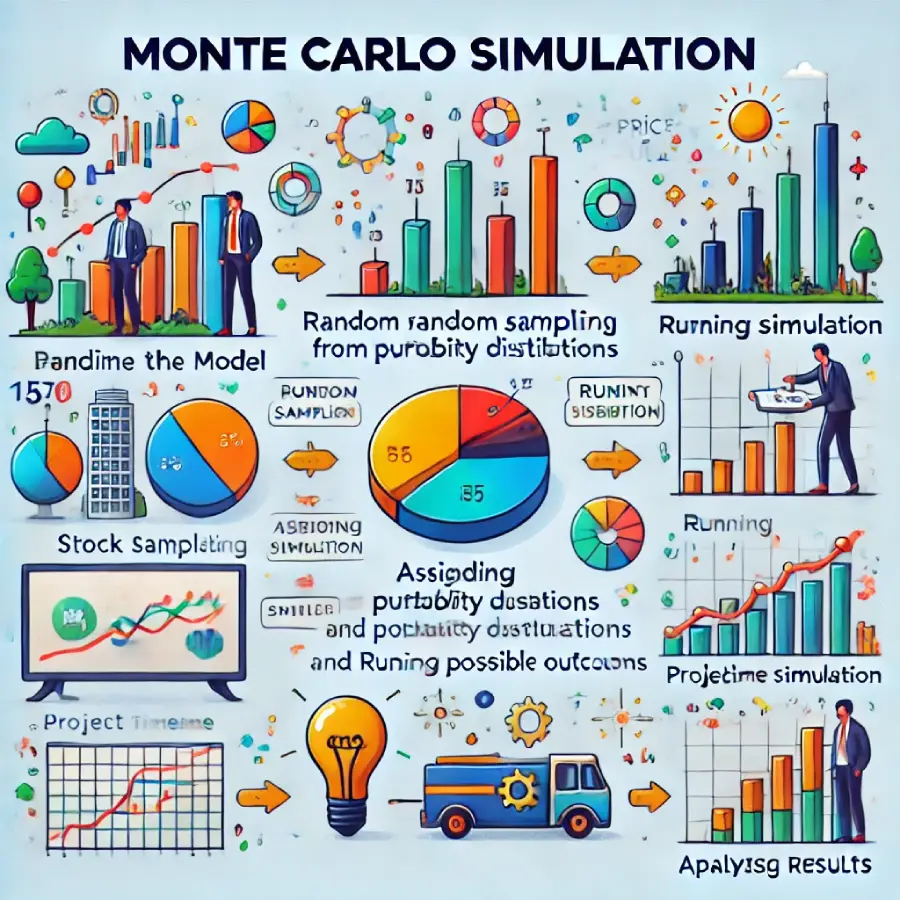

How Monte Carlo Simulation Works

Monte Carlo simulations typically follow these steps:

1. Define the Problem and Model

First, you must define the problem you are trying to solve. This could involve a financial forecast, an engineering system, or a physical process. You then build a model representing the system or process, incorporating relevant variables and their interactions. These variables might include financial returns, costs, waiting times, or physical measurements.

2. Assign Probability Distributions

Each input variable in the model is associated with a probability distribution that reflects the uncertainty in its value. Common probability distributions used in Monte Carlo simulations include:

- Uniform Distribution: Used when all outcomes within a range are equally likely.

- Normal Distribution: Often used when values are expected to cluster around a mean with some variability.

- Log-normal Distribution: Common for financial variables like stock prices.

- Exponential Distribution: Useful for modeling waiting times between events in a Poisson process.

3. Random Sampling

Once the probability distributions for the input variables are defined, random samples are generated for each variable according to its probability distribution. These samples are used to simulate a single outcome for the model.

4. Run Simulations

This process of sampling is repeated many times—often thousands or even millions of times—to account for all possible outcomes. Each simulation provides one possible outcome of the model, and by repeating the process, a large set of possible outcomes is generated.

5. Analyze Results

The results from the simulations are then analyzed statistically to estimate probabilities, averages, standard deviations, and other metrics. Monte Carlo simulations provide insights into:

- Expected values: What is the average result?

- Variance and standard deviation: How much do the results vary?

- Risk analysis: What is the probability of extreme outcomes?

Key Features of Monte Carlo Simulation

1. Randomness and Stochastic Processes

Monte Carlo Simulation is fundamentally about randomness. It relies on generating random variables from known probability distributions to simulate a wide range of possible outcomes. The random sampling process is the key feature that sets Monte Carlo methods apart from deterministic methods.

2. Convergence

As the number of simulations increases, the results of a Monte Carlo simulation converge towards the true solution. The law of large numbers ensures that, with enough simulations, the average result will approximate the expected value.

3. Computational Efficiency

Monte Carlo simulations are computationally intensive because they involve running thousands or millions of random samples. With modern computers, these simulations are feasible, but their efficiency depends on factors like the complexity of the model and the number of variables involved.

Applications of Monte Carlo Simulation

1. Finance and Investment Analysis

In finance, Monte Carlo Simulation is widely used for risk analysis, portfolio management, and option pricing. Financial markets are inherently uncertain, with many variables influencing asset prices. Monte Carlo simulations help to:

- Estimate portfolio returns: Investors can simulate how different asset allocations perform under various market conditions.

- Value financial derivatives: The Black-Scholes model, for example, can be extended using Monte Carlo methods to simulate the future behavior of stock prices and estimate the fair value of options.

- Assess Value-at-Risk (VaR): Monte Carlo simulations can calculate the probability of large losses in a portfolio, helping risk managers make informed decisions.

2. Engineering and Manufacturing

In engineering, Monte Carlo Simulation is used to model the reliability and performance of systems under uncertainty. Examples include:

- Reliability analysis: Engineers can simulate the failure rates of components in complex systems, such as electrical grids or mechanical systems, and assess the probability of system failure.

- Manufacturing optimization: Monte Carlo simulations help in optimizing production processes, predicting product defects, and improving quality control by modeling random variations in the manufacturing process.

3. Physics and Particle Simulations

Monte Carlo methods have a long history in physics, particularly in modeling physical systems with randomness. Some applications include:

- Particle transport: In nuclear physics and astrophysics, Monte Carlo simulations are used to model the movement of particles (e.g., photons, electrons) through matter.

- Thermodynamics: Simulating the behavior of gas molecules or liquids to understand thermodynamic properties like pressure, temperature, and entropy.

4. Project Management

Monte Carlo Simulation is also useful in project management, where it can be applied to estimate project timelines, costs, and risks. By modeling uncertainties such as delays, resource constraints, and cost overruns, project managers can make better-informed decisions about project timelines and budgets.

5. Healthcare and Epidemiology

In healthcare, Monte Carlo simulations are used to model the spread of diseases, estimate the effectiveness of treatments, and analyze healthcare costs. Epidemiologists can simulate the spread of infectious diseases like COVID-19, estimate infection rates, and predict the impact of interventions such as vaccination programs.

Advantages and Limitations of Monte Carlo Simulation

Advantages

- Flexibility: Monte Carlo Simulation can model virtually any system with uncertainty. It is highly versatile and can be applied to problems across multiple domains.

- Easy to implement: Once a probability distribution for inputs is known, Monte Carlo simulations are easy to set up and execute.

- Provides probabilistic outcomes: Instead of a single point estimate, Monte Carlo methods provide a range of possible outcomes, giving insights into the risks and probabilities of different scenarios.

Limitations

- Computationally expensive: Monte Carlo Simulation can be computationally intensive, especially for complex models requiring many simulations.

- Dependence on input data: The accuracy of the results depends heavily on the accuracy of the input probability distributions. If the inputs are poorly defined, the simulation results may be misleading.

- Random sampling errors: Monte Carlo results rely on random sampling, which can introduce variability. A large number of simulations are often required to ensure reliable results.

Conclusion

Monte Carlo Simulation is a versatile and powerful tool for analyzing systems under uncertainty. By using random sampling and probability distributions, it can provide insights into a wide range of complex problems in finance, engineering, physics, healthcare, and more. Despite its computational demands, Monte Carlo Simulation remains an essential technique for risk analysis, decision-making, and forecasting in various fields.