Introduction

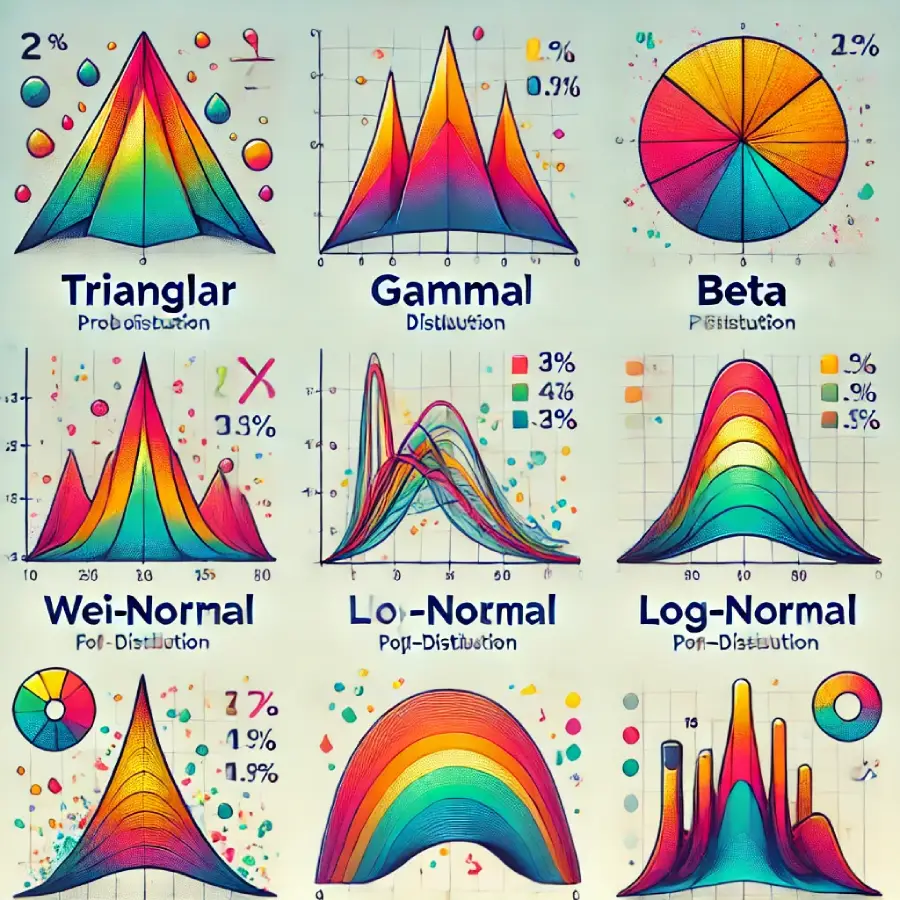

In probability theory and statistics, numerous probability distributions help model different types of random events. Some distributions are well-suited for modeling real-world processes like reliability, uncertainty, or risk, while others are valuable for theoretical applications. This article focuses on a variety of these distributions, including the Triangular, Gamma, Beta, and other less common distributions, providing a clear understanding of their properties, applications, and relationships to other distributions.

—

1. Triangular Distribution

Definition

The Triangular Distribution is a continuous probability distribution that is shaped like a triangle. It is defined by three parameters: the minimum value \( a \), the maximum value \( b \), and the mode \( c \), which is the most likely outcome. It is used when only limited information about a distribution is available and when the data tends to cluster around a peak value (mode).

The probability density function (PDF) is piecewise linear, rising from the minimum \( a \) to the mode \( c \), and then falling back to the maximum \( b \).

\[

f(x) = \begin{cases}

\frac{2(x – a)}{(b – a)(c – a)} & \text{for } a \leq x < c, \\

\frac{2(b – x)}{(b – a)(b – c)} & \text{for } c \leq x \leq b.

\end{cases}

\]

Properties

– Mean (Expected Value): \( \text{E}[X] = \frac{a + b + c}{3} \)

– Variance: \( \text{Var}(X) = \frac{a^2 + b^2 + c^2 – ab – ac – bc}{18} \)

Applications

– Project Management: Used in PERT (Program Evaluation and Review Technique) for estimating project completion times when best-case, worst-case, and most likely times are known.

– Risk Assessment: The triangular distribution is used when data is scarce, and subjective estimates of minimum, maximum, and likely values are available.

– Business Modeling: Useful in financial modeling where a simple approximation of a distribution is needed.

—

2. Gamma Distribution

Definition

The Gamma Distribution is a continuous distribution that is used to model the time until an event occurs for the \( k \)-th time in a Poisson process, where events occur independently. It generalizes the Exponential distribution, which models the time until the first event.

The PDF of the Gamma distribution is:

\[

f(x; \alpha, \beta) = \frac{\beta^\alpha x^{\alpha – 1} e^{-\beta x}}{\Gamma(\alpha)} \quad \text{for } x \geq 0

\]

Where:

– \( \alpha \) (shape parameter) influences the shape of the distribution.

– \( \beta \) (rate parameter) is the inverse of the scale.

– \( \Gamma(\alpha) \) is the Gamma function.

Properties

– Mean: \( \text{E}[X] = \frac{\alpha}{\beta} \)

– Variance: \( \text{Var}(X) = \frac{\alpha}{\beta^2} \)

Applications

– Reliability Engineering: Used to model the lifespan of products or systems where time to failure depends on multiple factors.

– Queuing Theory: Applied in modeling waiting times where more than one event is required before a result (e.g., how long it takes for multiple tasks to complete).

– Meteorology and Hydrology: Used to model rainfall patterns and river discharge.

—

3. Beta Distribution

Definition

The Beta Distribution is a continuous probability distribution that is defined on the interval \([0, 1]\) and is parameterized by two shape parameters \( \alpha \) and \( \beta \). It is commonly used to model probabilities or proportions, as well as subjective beliefs in Bayesian statistics.

The PDF of the Beta distribution is:

\[

f(x; \alpha, \beta) = \frac{x^{\alpha – 1} (1 – x)^{\beta – 1}}{B(\alpha, \beta)} \quad \text{for } 0 \leq x \leq 1

\]

Where:

– \( \alpha \) and \( \beta \) are shape parameters that control the skewness of the distribution.

– \( B(\alpha, \beta) \) is the Beta function, which normalizes the distribution.

Properties

– Mean: \( \text{E}[X] = \frac{\alpha}{\alpha + \beta} \)

– Variance: \( \text{Var}(X) = \frac{\alpha \beta}{(\alpha + \beta)^2 (\alpha + \beta + 1)} \)

Applications

– Bayesian Inference: Used as a conjugate prior distribution for modeling probabilities in Bayesian statistics.

– Quality Control: Applied in reliability and quality control where proportions (like defect rates) need to be modeled.

– Psychology and Social Sciences: Used to model distributions of beliefs or attitudes on a bounded scale (e.g., likelihood of agreeing with a statement).

—

4. Weibull Distribution

Definition

The Weibull Distribution is a continuous distribution used to model the time to failure of a product or system. It is a generalization of the exponential distribution, allowing for a varying failure rate over time.

The PDF of the Weibull distribution is:

\[

f(x; \lambda, k) = \frac{k}{\lambda} \left( \frac{x}{\lambda} \right)^{k-1} e^{-(x/\lambda)^k} \quad \text{for } x \geq 0

\]

Where:

– \( \lambda \) is the scale parameter.

– \( k \) is the shape parameter, which controls the failure rate.

Properties

– Mean: \( \text{E}[X] = \lambda \Gamma(1 + \frac{1}{k}) \)

– Variance: \( \text{Var}(X) = \lambda^2 \left[ \Gamma(1 + \frac{2}{k}) – \left( \Gamma(1 + \frac{1}{k}) \right)^2 \right] \)

Applications

– Reliability and Survival Analysis: Used to model failure times of products, components, and systems in industries such as electronics, aerospace, and medical devices.

– Engineering: Weibull distribution is applied to model the breaking strength of materials.

—

5. Log-Normal Distribution

Definition

The Log-Normal Distribution models a random variable whose logarithm follows a normal distribution. If \( Y \) is normally distributed, then \( X = e^Y \) follows a log-normal distribution. This distribution is used when values are strictly positive and have skewed distributions.

The PDF is given by:

\[

f(x; \mu, \sigma) = \frac{1}{x \sigma \sqrt{2\pi}} e^{-\frac{(\ln x – \mu)^2}{2\sigma^2}} \quad \text{for } x > 0

\]

Where:

– \( \mu \) is the mean of the natural logarithm of \( X \).

– \( \sigma \) is the standard deviation of the natural logarithm of \( X \).

Properties

– Mean: \( \text{E}[X] = e^{\mu + \sigma^2/2} \)

– Variance: \( \text{Var}(X) = \left( e^{\sigma^2} – 1 \right) e^{2\mu + \sigma^2} \)

Applications

– Finance: Used to model stock prices, as the log-normal distribution captures the multiplicative nature of price changes and the fact that prices cannot be negative.

– Biology and Medicine: Applied in modeling biological variables like the size of cells or the incubation period of diseases.

—

6. Pareto Distribution

Definition

The Pareto Distribution is a power-law probability distribution that is used to describe the distribution of wealth, natural phenomena, and social structures, where a small proportion of the population holds most of the quantity (e.g., wealth).

The PDF is:

\[

f(x; x_m, \alpha) = \frac{\alpha x_m^\alpha}{x^{\alpha+1}} \quad \text{for } x \geq x_m

\]

Where:

– \( x_m \) is the minimum possible value.

– \( \alpha \) is the shape parameter that controls the tail behavior.

Properties

– Mean: \( \text{E}[X] = \frac{\alpha x_m}{\alpha – 1} \) (for \( \alpha > 1 \))

– Variance: \( \text{Var}(X) = \frac{\alpha x_m^2}{(\alpha – 1)^2 (\alpha – 2)} \) (for \( \alpha > 2 \))

Applications

– Economics: The Pareto distribution is used to model wealth distributions where a small percentage of people control a large percentage of total wealth.

– Insurance and Risk Management: Used to model the distribution of large claims or extreme events.

—

Conclusion

This overview highlights the diversity of probability distributions available for modeling various real-world phenomena. From simple approximations like the Triangular Distribution to more complex models like the Gamma, Beta, and Weibull Distributions, each distribution has its own set of properties and applications. Understanding these distributions is crucial for selecting the right model to fit your data and accurately interpret results across different fields, from engineering and finance to project management and social sciences.