Effective cost management is essential for maintaining profitability in the Food and Beverage (F&B) department. This section outlines the components of Cost of Sales and Other Revenue as defined in the Uniform System of Accounts for the Lodging Industry (USALI).

1. Cost of Food and Beverage Sales

1.1 Cost of Food Sales

This includes the cost of all food items served to guests across various revenue categories:

- Included:

- Food used in preparation and service

- Beverage items used in food preparation (e.g., wine for cooking)

- Spoilage, waste, and spillage

- Coffee, tea, milk, juice, soda, and other non-alcoholic beverages

- Excluded:

- Food transferred to other departments

- Employee meals (charged to Staff Dining)

- Complimentary food (charged to appropriate expense accounts)

- Vendor rebates (credited to Cost of Food Sales)

Calculation: Cost of Food Sales / Total Food Revenue = Food Cost Percentage

1.2 Cost of Beverage Sales

Includes the cost of alcoholic beverages served to guests and any food used in beverage preparation:

- Included:

- Alcohol used in service

- Food/non-alcoholic items used in beverage service (e.g., garnishes, juices)

- Spoilage, waste, and spillage

- Excluded:

- Beverages transferred to other departments

- Complimentary beverages (charged as an expense elsewhere)

- Vendor rebates (credited to Cost of Beverage Sales)

Calculation: Cost of Beverage Sales / Total Beverage Revenue = Beverage Cost Percentage

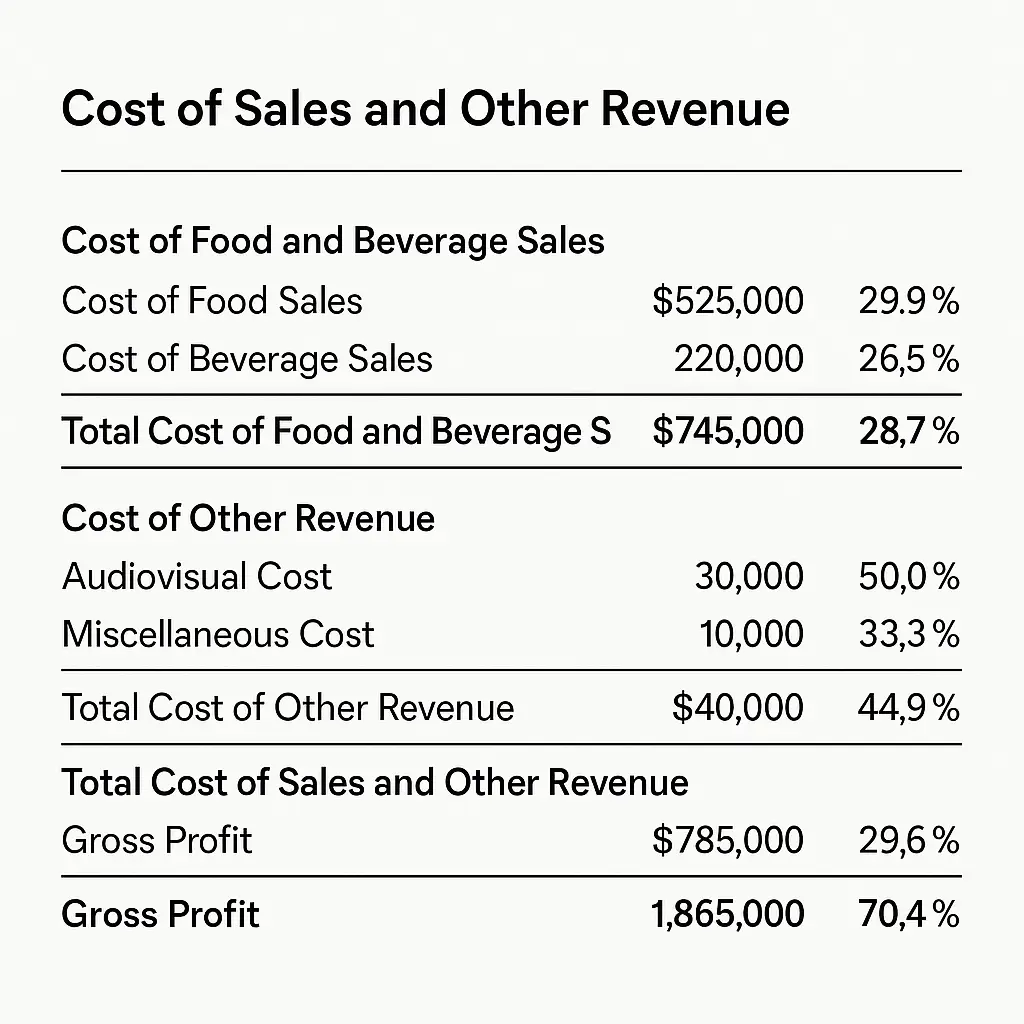

1.3 Total Cost of Food and Beverage Sales

Summing the cost of food and beverage sales provides a comprehensive view of direct consumption-related expenses.

Formula: Cost of Food Sales + Cost of Beverage Sales = Total Cost of Food and Beverage Sales

Percentage Calculation: Total Cost of Food and Beverage Sales / Total Food and Beverage Revenue

2. Cost of Other Revenue

Costs associated with non-consumable goods and services sold within the F&B department.

2.1 Audiovisual Cost

- Expenses related to the provision of audiovisual services and equipment to guests.

- Revenue is recorded under Other Revenue: Audiovisual.

2.2 Miscellaneous Cost

- Includes cost of memorabilia, branded items, and other services not related to food or beverage.

- Revenue is recorded as Miscellaneous Other Revenue.

2.3 Total Cost of Other Revenue

The combination of Audiovisual and Miscellaneous Costs.

Formula: Audiovisual Cost + Miscellaneous Cost = Total Cost of Other Revenue

Percentage Calculation: Total Cost of Other Revenue / Total Other Revenue

3. Total Cost of Sales and Other Revenue

Provides a holistic view of all direct costs related to sales across consumable and non-consumable items.

Formula: Total Cost of Food and Beverage Sales + Total Cost of Other Revenue

Percentage Calculation: Total Cost of Sales and Other Revenue / Total Revenue (F&B Department)

4. Gross Profit

Gross Profit highlights the remaining revenue after covering all direct costs.

Formula: Total Revenue – Total Cost of Sales and Other Revenue = Gross Profit

Percentage Calculation: Gross Profit / Total Revenue

Accurately calculating and analyzing these cost metrics enables hoteliers to benchmark performance, make informed decisions, and drive operational efficiency in the Food and Beverage department.