📉 Real-Time Trading Assistants: The AI Co-Pilots of Modern Markets

Markets no longer sleep—and neither should your trading strategy. In the 2025 financial landscape, where milliseconds make the difference between profit and loss, real-time AI trading assistants have emerged as the ultimate edge.

These AI-powered agents monitor markets 24/7, analyze data streams from every corner of the web, and execute trades or recommendations based on goals, context, and risk appetite—all without needing human supervision.

Let’s explore what these autonomous co-pilots do, how they’re changing finance, and why they may soon be on every trader’s screen.

⚡ What Is a Real-Time Trading Assistant?

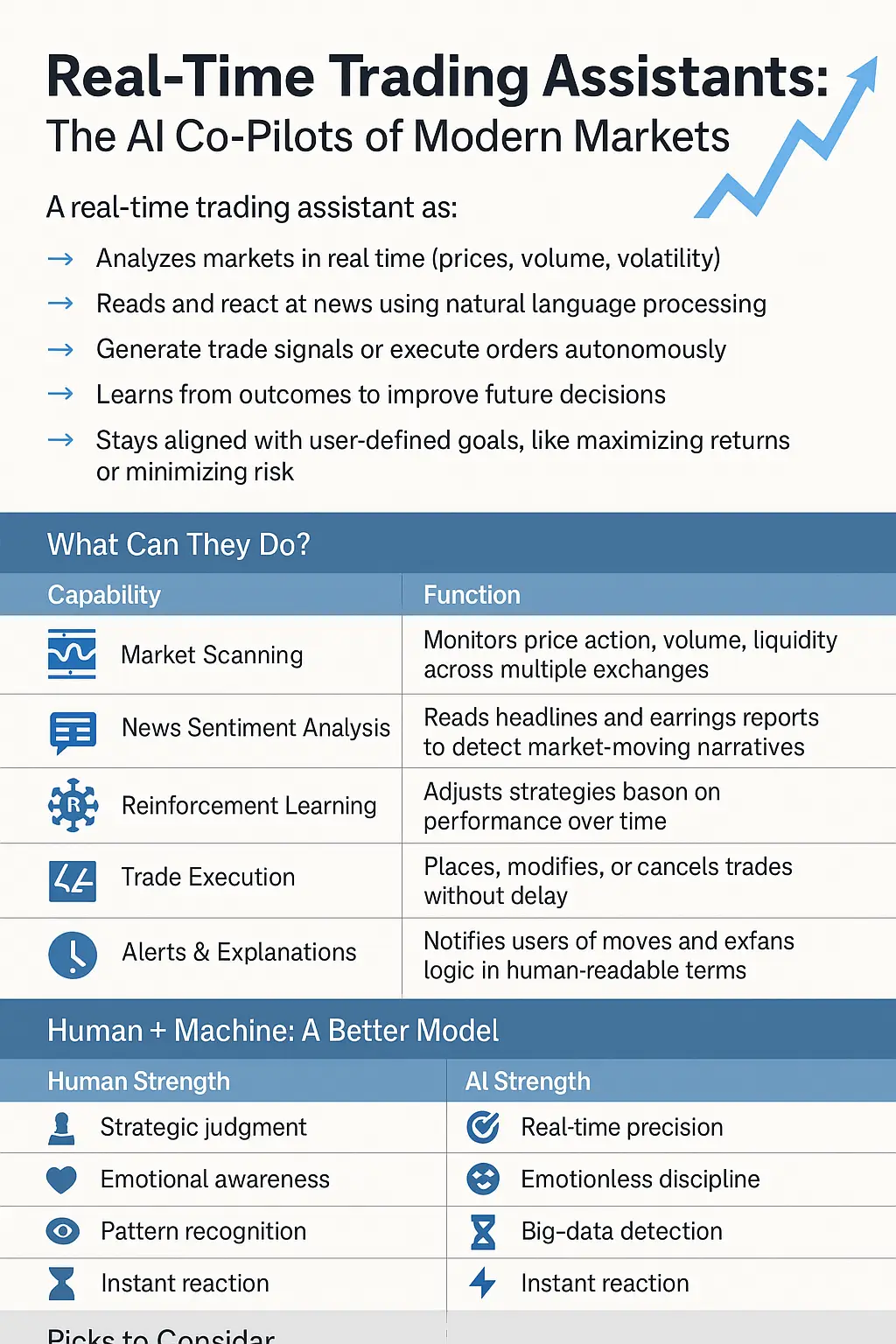

A real-time trading assistant is an AI system that:

- Analyzes markets in real time (prices, volume, volatility)

- Reads and reacts to news using natural language processing

- Generates trade signals, or executes orders autonomously

- Learns from outcomes to improve future decisions

- Stays aligned with user-defined goals, like maximizing returns or minimizing risk

These aren’t static trading bots from a decade ago. They’re adaptive, autonomous, and context-aware.

📈 What Can They Do?

| Capability | Function |

|---|---|

| 📊 Market Scanning | Monitors price action, volume, liquidity across multiple exchanges |

| 📰 News Sentiment Analysis | Reads headlines and earnings reports to detect market-moving narratives |

| 🧠 Reinforcement Learning | Adjusts strategies based on performance over time |

| 🧾 Trade Execution | Places, modifies, or cancels trades without delay |

| 💬 Alerts & Explanations | Notifies users of moves and explains logic in human-readable terms |

These agents are not just for Wall Street—they’re being adopted by hedge funds, retail apps, and even neobanks.

💡 Why They Matter Now

1. Too Much Data for Humans Alone

With thousands of assets and millions of signals per second, human traders simply can’t keep up. AI can.

2. 24/7 Markets Require 24/7 Monitoring

Crypto and forex never sleep. Trading assistants fill the gap.

3. Speed is Alpha

AI reacts to earnings surprises, geopolitical events, and order book shifts faster than human reflexes.

4. Risk Reduction

AI can detect patterns that precede crashes or anomalies—and pull back before losses compound.

🧭 Human + Machine: A Better Model

The smartest investors aren’t asking “Can AI beat me?” They’re asking “How can AI help me win?”

| Human Strength | AI Strength |

|---|---|

| Strategic judgment | Real-time precision |

| Emotional awareness | Emotionless discipline |

| Pattern recognition | Big-data detection |

| Long-term thinking | Instant reaction |

This synergy creates co-pilot models: traders set the goals and boundaries; AI handles the data, risk, and speed.

⚠️ Risks to Consider

While powerful, AI assistants need proper oversight:

- Overfitting to past data can lead to losses in future scenarios

- Black-box behavior may limit transparency

- False signals from low-quality data must be filtered

- Regulatory scrutiny is increasing, especially for autonomous trading systems

Best practice: maintain a human in the loop for high-stakes decisions or to halt erratic behavior.

🧠 Final Thoughts

Real-time trading assistants represent the next evolution in active investing—faster than any team of analysts, scalable across markets, and tireless in execution. But they don’t replace human skill. They amplify it.

“The future of trading isn’t man vs. machine. It’s man with machine vs. everyone else.”