AI in Banking & Investments: Transforming Financial Services

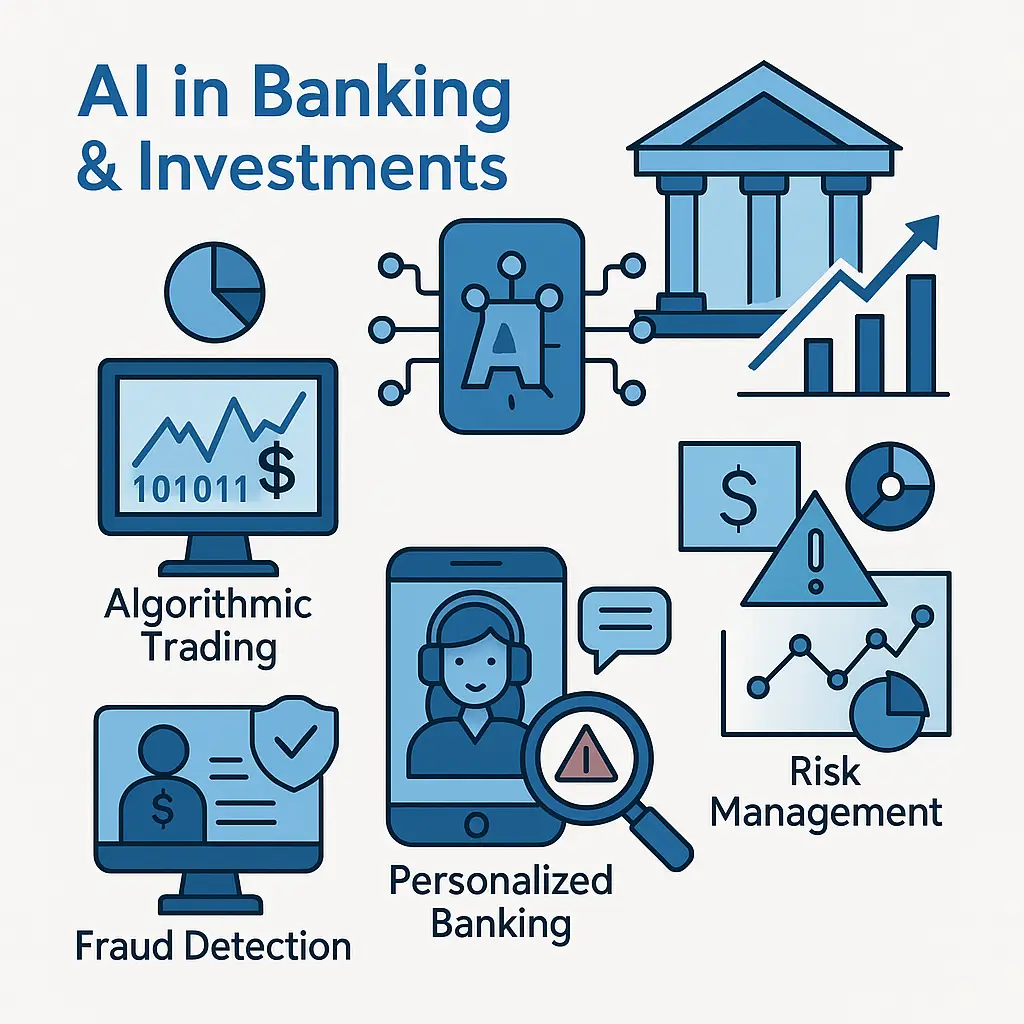

Artificial intelligence is reshaping the banking and investment landscape. From algorithmic trading to personalized financial planning, AI-powered tools drive efficiency, enhance customer experiences, and uncover new revenue streams. In this post, we’ll explore the key AI applications in banking and investments, provide real-world examples, outline their business benefits, and offer best practices for implementation.

Table of Contents

- Key AI Applications

- Algorithmic & High-Frequency Trading

- Personalized Digital Banking

- Fraud Detection & Anti-Money Laundering

- Credit Underwriting & Risk Analytics

- Robo-Advisory & Portfolio Optimization

- Real-World Examples

- Business Benefits

- Implementation Best Practices

- Regulatory & Ethical Considerations

- Future Trends

- Conclusion

Key AI Applications

Algorithmic & High-Frequency Trading

AI models analyze market microstructure and execute trades in milliseconds—optimizing execution strategies and reducing market impact.

Personalized Digital Banking

Chatbots and virtual assistants provide 24/7 support, while AI-driven analytics deliver tailored product recommendations and financial insights.

Fraud Detection & Anti-Money Laundering (AML)

Machine learning algorithms monitor transaction patterns in real time, flagging anomalies and suspicious activities far beyond static rule-based systems.

Credit Underwriting & Risk Analytics

AI evaluates non-traditional data (e.g., social media, utility bills) to enhance credit scoring models, expanding access to under-banked populations.

Robo-Advisory & Portfolio Optimization

Automated platforms use AI to build and rebalance client portfolios according to goals, risk tolerance, and market forecasts—often at a fraction of traditional advisory costs.

Real-World Examples

- JPMorgan’s LOXM: An AI trading engine that executes complex orders by learning from prior trades to minimize market impact and cost.

- Bank of America’s Erica: A virtual assistant serving over 10 million users, helping with balances, bill payments, and spending insights.

- HSBC’s AI AML System: Processes millions of transactions daily, reducing false positives by 60% and enabling faster investigations.

- Zest AI: Uses machine learning to underwrite loans in minutes, widening credit access for borrowers with limited credit history.

- Betterment & Wealthfront: Robo-advisors that optimize portfolios using AI-driven tax-loss harvesting and dynamic asset allocation.

Business Benefits

- Reduced Costs

Automating back-office processes and advisory tasks cuts operational expenses. - Enhanced Customer Experience

Personalized recommendations and instant support boost engagement and loyalty. - Improved Risk Management

Real-time detection of fraud and market anomalies safeguards assets and reputation. - Scalability

AI platforms handle surges in volume—whether trading orders or customer inquiries—without proportional headcount increases.

Implementation Best Practices

- Data Quality & Governance

Centralize and clean structured and unstructured data; establish strong data-governance policies. - Model Validation & Monitoring

Backtest trading and credit models regularly; monitor for drift and performance degradation. - Explainability

Use explainable AI techniques (e.g., SHAP, LIME) for transparent decisioning, especially in credit and compliance contexts. - Integration & Security

Ensure secure APIs between AI modules and core banking systems; use encryption and role-based access controls.

Regulatory & Ethical Considerations

- Fair Lending & Bias

Audit AI credit models to prevent discriminatory outcomes and comply with fair-lending laws. - Data Privacy

Adhere to GDPR, CCPA, and other data-protection regulations when using customer data. - Model Risk Management

Document model assumptions, maintain audit trails, and establish governance committees to oversee AI deployments.

Future Trends

- Federated Learning for cross-bank collaboration on fraud and risk models without sharing raw data.

- Conversational AI Evolution with voice and multi-modal interfaces for richer customer interactions.

- Quantum-Enhanced Trading as quantum computing matures, enabling ultra-fast optimization and simulation.

- Embedded Finance Extensions where banking and investment services are seamlessly integrated into non-financial platforms via AI APIs.

Conclusion

AI’s impact on banking and investments is profound—driving faster, smarter, and more personalized services while strengthening risk controls. Financial institutions that invest in robust data infrastructure, governance, and explainable AI will lead the next wave of innovation.

Next step: Identify a high-impact AI use case in your organization—such as fraud detection or robo-advisory—and run a pilot project to validate value before full-scale rollout.

External Links:

- Federal Reserve – Fintech and Payments

- BIS – AI in Banking