🤖 Agentic AI in Finance: Redefining the Future of Financial Services

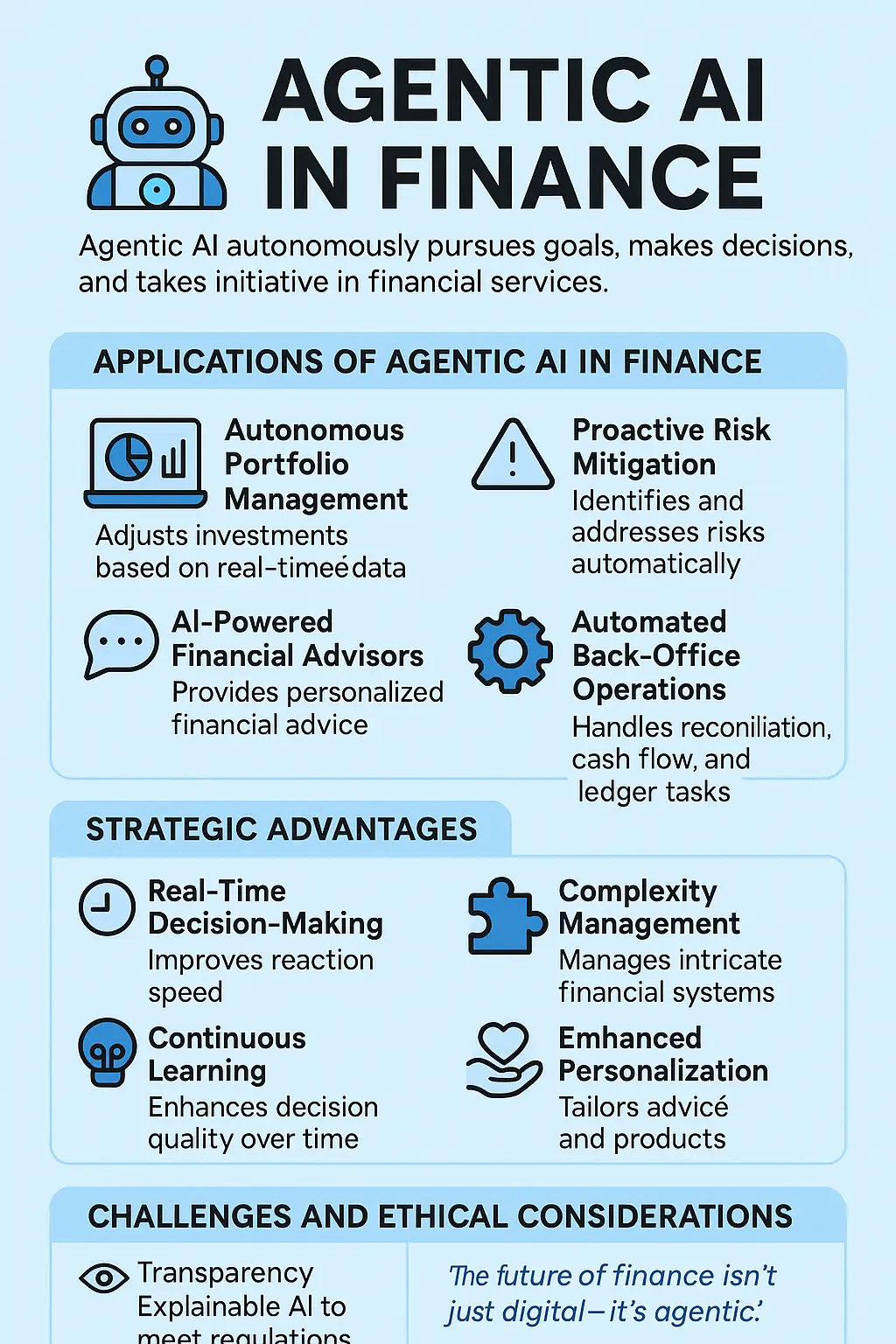

Artificial Intelligence (AI) is transforming every sector it touches, but one of the most compelling evolutions lies in the emergence of agentic AI—AI systems that can autonomously pursue goals, make decisions, and take initiative without constant human prompting. In the world of finance, this represents a profound shift from traditional automation to a new era of dynamic, intelligent agents that act independently to deliver value.

🔍 What Is Agentic AI?

Agentic AI refers to systems that operate with a degree of autonomy and intentionality. Unlike conventional AI models that perform specific tasks only when triggered, agentic AI agents:

- Set and pursue goals independently

- React to changes in their environment

- Adapt strategies to meet objectives

- Interact with humans and systems proactively

These agents are designed to simulate a form of “agency,” often within constraints and objectives defined by developers or users.

In finance, this means shifting from passive analytics or static bots to intelligent systems that actively manage portfolios, mitigate risk, and even engage with clients in real time.

🏦 Applications of Agentic AI in Finance

1. 💼 Autonomous Portfolio Management

Agentic AI can act as a virtual fund manager, adjusting investment portfolios based on real-time market movements, news sentiment, and economic indicators. Instead of executing fixed strategies, it continuously re-evaluates its decisions to meet investor goals.

Example: An agent might reduce exposure to emerging markets after detecting political instability using news sentiment analysis—without waiting for human input.

2. ⚠️ Proactive Risk Mitigation

Traditional risk systems issue alerts for human teams to interpret. Agentic AI, however, can detect emerging risks and autonomously take action—like rebalancing assets, flagging fraudulent transactions, or triggering compliance workflows.

Example: Detecting irregular cash flow in a corporate account and freezing specific transactions before harm occurs.

3. 🤖 AI-Powered Financial Advisors

Agentic AI enables digital advisors to go beyond scripted chatbots. These advisors can:

- Monitor your spending habits

- Recommend financial products dynamically

- Alert you of budget risks or tax opportunities

- Schedule financial health checks based on your goals

This fosters a hyper-personalized, continuous client experience.

4. 🧠 Autonomous Research Agents

In investment banking and equity research, agentic AI can autonomously:

- Read financial statements

- Track regulatory changes

- Summarize quarterly earnings

- Generate initial investment theses

This dramatically cuts time-to-insight and enhances productivity.

5. 🔄 Automated Back-Office Operations

In corporate finance and treasury, agentic systems can automate:

- Reconciliation of ledgers

- Liquidity forecasting

- Cash flow management

- Debt scheduling and restructuring

They continuously learn from past decisions and improve performance over time.

🌐 Why It Matters: Strategic Advantages

| Benefit | Description |

|---|---|

| ⏱️ Real-Time Decision-Making | Agents can act immediately on data, improving reaction speed. |

| 🧩 Complexity Management | Handle intricate systems like global markets or derivatives with fewer human bottlenecks. |

| 🧠 Continuous Learning | Use reinforcement learning and feedback loops to improve decision quality over time. |

| 🤝 Enhanced Personalization | Tailor financial products and advice to individual behaviors and goals. |

| 🔐 Improved Security | Monitor behavior patterns continuously to detect and respond to anomalies. |

⚖️ Challenges and Ethical Considerations

As with any advanced technology, agentic AI comes with challenges:

- Transparency: Decisions made by agents must be explainable to comply with regulations like GDPR or Basel III.

- Bias & Fairness: Autonomous agents must not reinforce socioeconomic bias when offering credit, insurance, or investment advice.

- Control: Financial institutions must design agents with clear constraints and fallback mechanisms to prevent rogue behavior.

- Trust: Clients and regulators must trust AI agents to act responsibly and in their best interest.

🚀 The Road Ahead: Toward Financial Autonomy

Agentic AI is not just another layer of automation—it’s a paradigm shift. As these systems mature, we’ll see financial services move toward a “co-pilot” model, where humans supervise and collaborate with agentic AI, delegating complex or repetitive tasks while retaining oversight.

In the long term, entire banking operations could become agent-led ecosystems, with minimal human intervention in routine tasks and a stronger emphasis on strategic, creative, and ethical decision-making by humans.

✍️ Final Thoughts

Agentic AI offers immense potential for innovation in finance, from democratizing investment management to making risk oversight faster and smarter. But its adoption requires careful design, regulation, and integration with human values.

As financial institutions evolve, those that successfully harness the power of agentic AI will lead the way in creating intelligent, adaptive, and human-centric financial systems.

“The future of finance isn’t just digital—it’s agentic.”