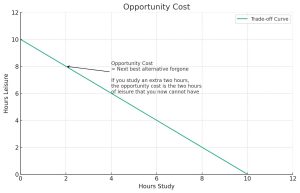

Opportunity cost in economics refers to the value of the next best alternative that is forgone when a decision is made to pursue a particular action. It’s the cost of the “road not taken,” so to speak. Understanding opportunity cost helps in evaluating the true cost of choices, as it considers what you could have done instead with the same resources.

Here are a few examples to illustrate the concept:

1. **Educational Decisions**: If you choose to go to college, the opportunity cost might include the income you would have earned if you worked instead. This cost includes not just the tuition fees but also the potential earnings foregone during the years spent in education.

2. **Business Decisions**: A company decides to use a sum of money to upgrade its factory equipment instead of expanding its workforce. The opportunity cost here is the potential benefits that the company might have gained from hiring more employees, like increased production or diversification of products.

3. **Personal Finance**: You have $10,000 to invest and choose to buy stocks. The opportunity cost is the potential returns you could have earned by putting that money into a different investment, like bonds or real estate.

4. **Government Spending**: When a government chooses to allocate funds to military spending, the opportunity cost is what could have been funded instead, such as education, healthcare, or infrastructure development.

5. **Time Management**: Choosing to spend an evening watching a movie instead of studying for an exam. The opportunity cost is the potential better grade or deeper understanding of the subject matter that could have been achieved through studying.

In each of these examples, the opportunity cost is not just about money but also includes other resources like time and effort. It’s a fundamental concept for making informed decisions in both personal and professional contexts.