Introduction

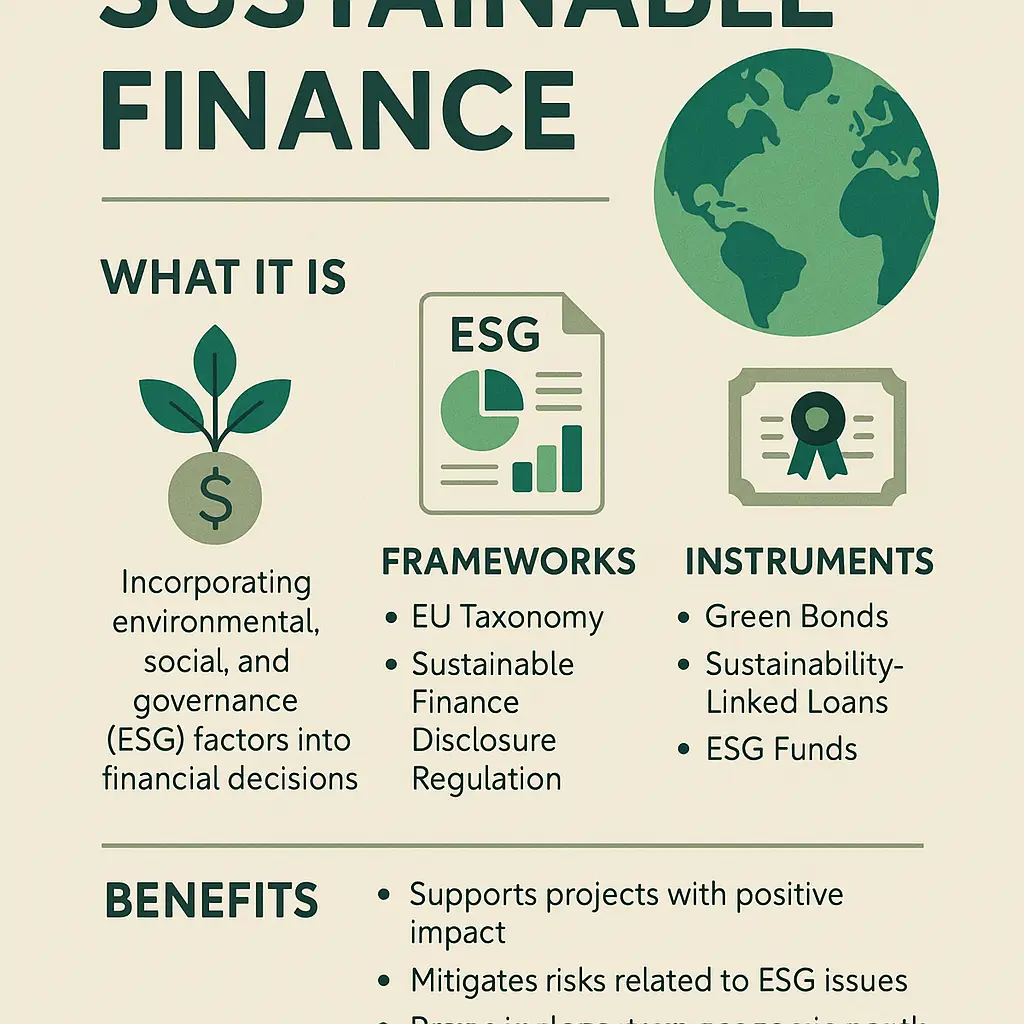

Sustainable finance integrates environmental, social, and governance (ESG) factors into financial decisions to support long-term economic growth, address climate change, and foster social well-being. It encompasses a range of frameworks, instruments, and practices aimed at directing capital toward projects and companies with positive ESG impacts while managing risks associated with sustainability challenges.

1. Defining Sustainable Finance

Sustainable finance refers to financial activities—investment, lending, insurance, and advisory—that explicitly consider ESG criteria alongside traditional financial analysis. This approach seeks to align financial returns with sustainable outcomes, ensuring that capital flows contribute to climate mitigation, social inclusion, and responsible governance.

2. Key Frameworks and Regulations

- EU Taxonomy: A classification system defining which economic activities qualify as environmentally sustainable, guiding investors and companies in Europe to align with net-zero and broader environmental goals (finance.ec.europa.eu). Recent draft delegated acts simplify reporting templates and exempt minor activities from extensive disclosures (finance.ec.europa.eu).

- Sustainable Finance Disclosure Regulation (SFDR): Requires financial market participants in the EU to disclose how ESG factors are integrated into their investment decisions and products, enhancing transparency.

- Principles for Responsible Investment (PRI): Voluntary guidelines for investors to incorporate ESG issues into investment analysis and ownership practices.

- National Taxonomies and Roadmaps: Countries such as Australia have launched their own sustainable finance taxonomies to guide domestic investment via voluntary frameworks (climatebonds.net).

3. Instruments in Sustainable Finance

- Green Bonds: Debt securities where proceeds fund projects with environmental benefits (renewable energy, energy efficiency, climate adaptation). Global green bond issuance reached around $670 billion in 2024, with total labeled sustainable bond issuance at over $1 trillion, reflecting continued growth (thedocs.worldbank.org, climatebonds.net). However, issuance dynamics vary regionally; for example, U.S. green bond issuance dipped under $25 billion by May 2025 amid “greenhushing,” while Europe remains more active (ft.com).

- Sustainability-Linked Loans (SLLs): Loans where pricing or terms adjust based on borrower’s achievement of predefined sustainability targets (e.g., emissions reduction).

- ESG Funds and ETFs: Investment funds that select assets based on ESG criteria; these include active and passive vehicles tracking ESG indices.

- Sustainability-Linked Bonds: Similar to SLLs, with coupon adjustments linked to sustainability performance.

- Blended Finance & Impact Investing: Combining public or philanthropic funds with private capital to mobilize investment in projects with developmental and environmental objectives.

4. Market Trends and Developments

- Growth and Issuance Trends: The labeled sustainable bond market grew to $1.1 trillion in 2024, a 5% increase from 2023, and is expected to hold around $1 trillion in 2025 amid broader bond market expansion (thedocs.worldbank.org). Despite political headwinds in some regions, global momentum persists, particularly in Europe and Asia where regulatory support and investor demand remain strong.

- Regional Variations: U.S. companies have engaged in “greenhushing,” avoiding labeling debt as green under political pressure, yet continue financing clean energy projects behind the scenes (ft.com). Conversely, Europe advances taxonomy refinements and increased transparency requirements, while Asia sees growing interest supported by government incentives (ft.com).

- Sector Focus: Climate-related investments dominate, with significant funding for renewable energy, energy efficiency, sustainable transport, and adaptation. Ocean finance also garners attention: commitments at the U.N. Ocean Conference include multi-billion-euro pledges for marine conservation and resilience projects (reuters.com).

- Integration in Education and Practice: Business schools are shifting ESG curricula from idealistic frameworks to pragmatic applications, emphasizing technical skills in sustainability assessment and risk management (ft.com). Financial institutions increasingly embed sustainability criteria into credit analysis, portfolio management, and advisory services.

5. Benefits of Sustainable Finance

- Risk Mitigation: Incorporating ESG factors helps identify and manage long-term risks (climate, regulatory, reputational) that can affect asset values and creditworthiness.

- Access to Capital: Companies demonstrating credible sustainability strategies may access a broader investor base and benefit from favorable financing terms (greenium).

- Positive Impact: Directs capital to projects that generate environmental and social benefits, supporting global goals like the Paris Agreement.

- Resilience and Innovation: Encourages innovation in clean technologies and business models, enhancing long-term resilience of firms and economies.

6. Challenges and Considerations

- Greenwashing: Risk of mislabeling or exaggerating sustainability credentials. Robust standards and verification (e.g., Climate Bonds Certification) are essential to maintain market integrity (climatebonds.net).

- Regulatory Complexity: Evolving and sometimes fragmented regulatory frameworks (e.g., differing national taxonomies) can create compliance burdens for firms. Ongoing efforts aim to simplify and harmonize reporting (regulatoryandcompliance.com).

- Data and Measurement: High-quality, standardized ESG data are critical but often lacking; methodologies for measuring impact vary, complicating comparisons.

- Market Volatility: Economic downturns or political shifts (e.g., changing administrations) can affect sustainable finance momentum, as seen in fluctuations in U.S. green bond labeling and investor sentiment (ft.com).

- Affordability and Accessibility: Sustainable finance instruments may have higher upfront costs or complexity, potentially limiting access for smaller issuers or investors without specialized expertise.

7. Best Practices for Stakeholders

- For Issuers: Develop clear sustainability strategies with measurable targets; obtain third-party verification or certification; engage stakeholders transparently; align with relevant taxonomies and disclosure requirements.

- For Investors: Conduct rigorous due diligence on ESG claims; diversify across regions and instruments; stay informed on evolving regulations (e.g., SFDR, taxonomy updates); engage with portfolio companies on sustainability practices.

- For Policymakers and Regulators: Strive for harmonization of frameworks; simplify reporting for small entities; enhance data disclosure standards; support capacity-building and education.

- For Financial Institutions: Integrate ESG into credit and risk frameworks; train staff in sustainability assessment; develop innovative products (e.g., green loans) tailored to client needs.

8. Future Outlook

Sustainable finance is poised to remain central to global financial markets as climate and social challenges intensify. Anticipated trends include further evolution of taxonomies and disclosure standards, growth in sustainability-linked instruments, increased digital solutions for ESG data collection, and expanding focus on social and transition finance. Collaboration among public and private sectors will be key to scaling investment for a sustainable transition.

References

- EU Taxonomy overview and recent simplification proposals (finance.ec.europa.eu, finance.ec.europa.eu)

- Labeled sustainable bond market update: $1.1 trillion issuance in 2024 (thedocs.worldbank.org)

- Climate Bonds data on aligned green bond issuance (climatebonds.net)

- “Greenhushing” in U.S. green bond market amid political shifts (ft.com)

- Education shift in ESG curricula and pragmatic focus (ft.com)

- Ocean finance commitments at U.N. Ocean Conference (reuters.com)

- Simplification of EU Taxonomy reporting recommendations (regulatoryandcompliance.com)