Continuity, Derivatives, and Optimization in Economics: A Practical Overview for Learners

Introduction

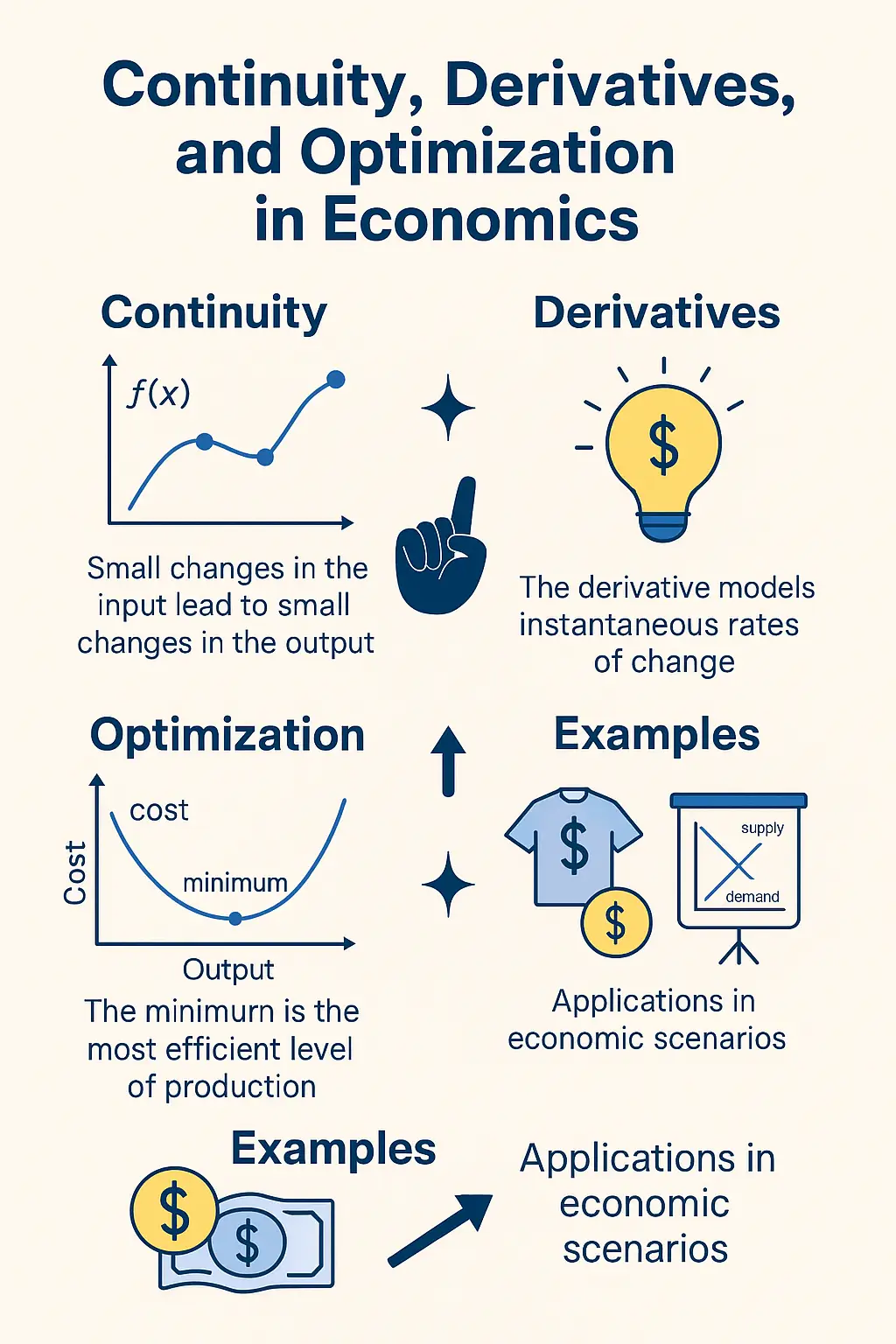

In the modern study of economics, mathematics provides the essential foundation for analyzing market behavior, production strategies, and financial decision-making. One of the most powerful mathematical tools for this purpose is the concept of functions and their continuity, differentiability, and optimization. This article breaks down these topics, making them accessible and engaging for students of economics.

Continuity in Economic Functions

Continuity reflects stability. A function is continuous at a point if small changes in the input result in small changes in the output. Visually, this means the graph of the function has no breaks at that point. In economic terms, continuity ensures predictable behavior: for example, that increasing the price slightly won’t cause a sudden jump in demand.

There are several types of discontinuities:

- Removable discontinuity (fixable gaps)

- Jump discontinuity (e.g., sudden tax increase)

- Infinite discontinuity (vertical asymptotes)

For instance, the demand function might be discontinuous at a specific price where market rules change.

Important Theorems Involving Continuity

- Weierstrass Theorem: A continuous function on a closed interval reaches a minimum and maximum.

- Intermediate Value Theorem (Bolzano): If a continuous function takes on opposite signs at two endpoints, it must cross zero somewhere in between. This is especially useful for finding root values, such as breakeven quantities.

Differentiation and Economic Interpretation

The derivative of a function measures its slope – that is, how fast it changes. In economics:

- Marginal cost (MC) is the derivative of the total cost function.

- Marginal revenue (MR) is the derivative of the total revenue function.

- Marginal profit is the difference: MR – MC.

For example, if , then:

At , the cost of producing one more unit is .

Rules of Differentiation

- Derivatives of constants are zero.

- Chain rule:

- Product rule and quotient rule apply for compound expressions.

These help economists work with complicated revenue and cost models that involve nested or composite functions.

Economic Discontinuities

Many real-world functions are not smooth. For instance:

- A firm selling shirts at a flat price experiences a revenue function with a sharp step.

- Demand functions with tiered pricing can lead to discontinuities where the pricing model changes.

These examples show why students should not only learn smooth calculus but also understand how models behave at “edges.”

Optimization in Economics

Optimization involves finding the maximum profit, lowest cost, or highest utility. The steps are:

- Find the first derivative () and set it to zero.

- Solve for critical points.

- Use the second derivative () to check if it’s a minimum (positive) or maximum (negative).

For example, if , then:

- Set to find profit-maximizing quantity.

Applications in Demand and Supply

- Demand functions typically slope downward:

- Supply functions slope upward:

- Equilibrium occurs when

These can be differentiated for sensitivity analysis or elasticity computation.

Conclusion

Continuity, derivatives, and optimization are more than just abstract math topics – they are the language of economic modeling. From maximizing profits to analyzing marginal effects and interpreting market equilibrium, understanding these core ideas empowers students and professionals alike to make smart, analytical decisions grounded in logic and clarity.

Whether you’re studying for exams or solving real-world business problems, this toolkit of calculus in economics is indispensable. And it all begins with a simple function.

Further Reading

- Chiang & Wainwright, Fundamental Methods of Mathematical Economics